Will the Cost of Basic Income be Borne on the Shoulders of the American Middle Class?

There are many arguments against the idea of an unconditional basic income, most based on a complete lack of any actual research. These arguments happen to be entirely logical, and even plausible, but simply aren't supported by the evidence that has already been accumulated over the decades to apply to them. There are other arguments however, that are not simply based on ignorance, but on an utter lack of critical thinking or rational thought. One such argument I wish to highlight below is the notion that UBI would be paid for, not by the rich, but by the middle class, and even the poorest themselves.

To disprove this argument requires only a rudimentary mathematical analysis. It simply isn't possible for the rich to be net receivers of UBI. The only possible way is to make entirely unrealistic assumptions or to redefine UBI so that we're no longer talking about UBI. But if we were to do that, the argument has already been disproven, and is thus pointless to make.

Don't believe me? Keep reading...

First of all, we have to define and understand what UBI is. UBI is a non-withdrawable tax-free cash stipend provided to an entire population, without conditions or requirements, sufficient for the purchasing of basic needs. Now, what is considered to be "basic" is arguable, but is usually considered as being somewhere near the poverty line, such that UBI functions as a vaccine against hunger and homelessness. In the United States, our poverty line in 2018 is defined as being $12,140 per year for a household of one person, with an additional $4,320 required per additional person in the household. So a UBI in the US would need to be somewhere in this range, perhaps a bit above or below, but certainly in that ballpark. $100 per month is not UBI, neither is $10,000 per month.

Now, let's take a "typical" American family of four, with two parents and two kids. The total UBI received by this household would be around $32,000 ($12,000 x 2 + $4,000 x 2). That same family has a before-tax income right now of $60,000, and using the new GOP tax plan a taxable income of $32,000 after deductions ($24,000 standard deduction + $4,000 in child tax credits). Their effective tax rate is around 12%, so they're paying around $3,840 in taxes, and being left with $56,160 after taxes.

In order for this typical family to receive no benefit whatsoever from UBI, their taxes would need to go up to being $35,840 ($32,000 + $3,840), because everyone receives UBI, so they would need to pay more in new taxes than they receive in UBI. That's the math. $35,840 represents a 933% increase in their taxes, such that their new effective tax rate would be just shy of 60%.

Does anyone out there truly believe that it's politically possible to raise taxes on the typical American family from 12% to 60%? And that wouldn't even include additional state and local taxes. At no point in American history has our effective tax rate ever been that high on the middle class. The highest effective tax rate on a family earning $60,000 in today's dollars was in 1945 at the height of WWII, and that rate was 24.4%.

Let's now then round up and establish 25% as a realistic upper limit for our typical American household of four. That's the maximum effective tax rate a median income earning household in the US can be expected to pay for UBI without qualifying as being higher than ever before in our history. That's about double today's rate. With that in mind, we can work backwards to find how much UBI would be realistically clawed back from middle income households via federal taxes on earned income above the basic income.

A family of four earning $60,000 and receiving $32,000 in UBI would have a total of $92,000 before taxes. Their taxable income would be the full $60,000 instead of $32,000 (because UBI would replace most all tax credits, especially the standard deduction and child tax credits). 25% of $60,000 is $15,000, which means after taxes they have $45,000 in earned income and $32,000 in UBI for a total of $77,000. That is equivalent to a $17,000 raise and a 0% tax rate, despite paying $15,000 in taxes instead of $3,840 like they do now under the new tax code. So their taxes go up to pay for UBI, but the UBI is equivalent to such a large refundable tax credit, that it essentially eliminates their entire tax burden, and refunds them an additional $17,000.

What is true for the middle class is even more true for lower income earners here. A family of four earning less than $60,000 and thus paying less in taxes, would receive an even larger monthly refund with the receipt of the same $32,000 UBI every other household of four receives.

So at what point does a household of four realistically become a net payer of UBI due to paying more than $32,000 in new taxes to pay for the UBI? Well, it depends on the tax rate, so let's use historic maximum effective tax rates again to help calculate a number.

A household with $165,000 in taxable income right now had the highest effective tax rate in 1981 of 33.4%. Right now that same family has an effective tax rate of 20.2% which is a tax bill of around $33,000. Because the difference between their pre-UBI tax bill ($33,000) and theoretical post-UBI tax bill ($64,000) is $31,000, they are essentially at the breakeven point, where their tax burdens go up the same amount as the UBI they begin to receive.

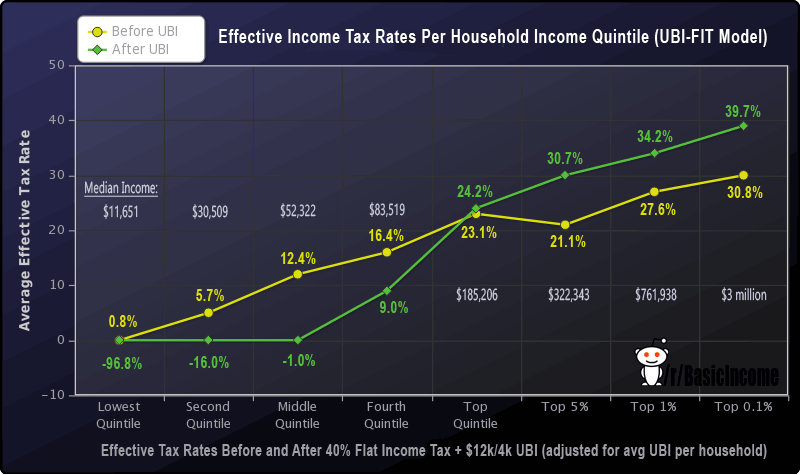

A realistic threshold is therefore around $165,000 for a family of four. Families earning more than that amount will be net payers, and families earning less than that will be net receivers. Using a traditional definition of middle class as having an upper limit of twice the median income, $165,000 exists outside that range. All but the richest 20% or so of households will see their tax burdens reduced under UBI. This can also be understood as Milton Friedman's negative income tax in action, where the net amount received or paid depends on one's income.

In fact, a UBI paired with a 40% flat income tax would be entirely identical to a negative income tax with a 40% clawback rate, both in cost and net outcome, and the result of both would be a more progressive tax system than we have now, where those with the most money spend more into the system. As automation continues eliminating jobs, this becomes increasingly important so as to neutralize the concentration of wealth and the collapse of consumer demand, and thus the economy itself.

Hopefully it should now be clear that because everyone receives UBI, it is nonsense to say that the burden of increased taxes will be borne by the working class. After taxes, the working class will finally, after far too many decades of stagnant wages, see a raise because of UBI. This can be seen as either earning more income or paying less taxes, but either way, around 8 out of 10 households are economically better off with UBI.

For that statement to not be true, would require a much smaller UBI, to the point it could not be called UBI, or such massive elimination of existing government services and tax credits that the UBI received is less than what is required to purchase the equivalent amount of lost services in the market. This fear tends to mostly be a fear of those on the left, but it too requires closer analysis, which I've done in a previous post.

TL;DR: Any UBI that can realistically be called an actual UBI by meeting the definition of UBI will significantly reduce the tax burdens of the poor, AND the American middle class.

Speaking of UBI fears that require closer analysis, please consider reading this next about the fear of inflation as a an unintended consequence of UBI.

Did you enjoy reading this? Please click the subscribe button and also consider making a monthly pledge in support of my daily advocacy of basic income for all.

_large.jpg)

UBI Guide Newsletter

Join the newsletter to receive the latest updates in your inbox.