Basic Income is now a dominant discussion in India's 2019 general election

NOTE: Want to listen to this post instead, or as you read it? Click here.

With the historic announcement by India's opposition party of an intention to implement basic income for the poor (not UBI), just two years after India's 2016-2017 Economic Survey called UBI "the shortest path to eliminating poverty," and seven years after the successful 2011-2012 UBI experiment in Madhya Pradesh, for perhaps the first time in history a country's two leading parties appear to now agree on the idea of just giving cash to people without strings and are instead fighting over who thought of it first, and what the details should be.

We cannot build a new India while millions of our brothers & sisters suffer the scourge of poverty.

If voted to power in 2019, the Congress is committed to a Minimum Income Guarantee for every poor person, to help eradicate poverty & hunger.

This is our vision & our promise.January 28, 2019

Indian agrarian crisis as opportunity for quasi-universal basic rural income (QUBRI):cash transfer of Rs.18,000/year to 75% of all rural households. Our new proposal @bsindia: https://t.co/E2HgSiko1S. Ungated: https://t.co/0z8XkYECQh. Longer version: https://t.co/MAHmboQYUb 1/nJanuary 28, 2019

What's so interesting about this development in India is that it's kind of like if a Democratic president had been toying around about implementing UBI if re-elected, and then the Republican party promised they would implement a UBI if elected. The debate then moves immediately to details versus concept alone.

In India, neither of the parties involved are talking full UBI ,(except in the state of Sikkim), but one is talking about a significant step towards it that's centered around farmers and rural areas, and now the other is talking about everyone under an income level. Unfortunately, neither of them fully understands the full value of full universality, because each is focused mostly on the poor.

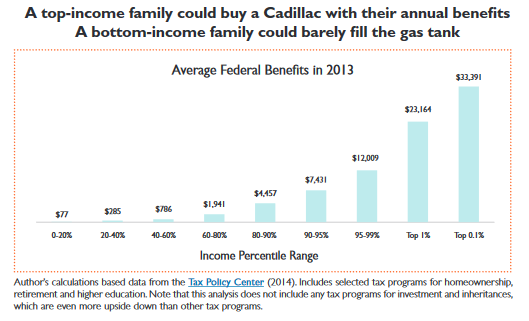

Here's the thing: If your concern is that those who "don't need UBI" don't get it, then regardless of your reasoning, you should simply support clawback via methods of taxation, not on the income itself. If you don't want someone to have $1,000 more, then just increase their taxes or decrease their existing tax subsidies by at least $1,000 to nullify the boost.

For example, in the U.S. tax code, taxpayers help the rich afford larger mansions by allowing them to deduct their mortgage interest. In a way, renters are pooling their money together to write $30,000 checks to the rich to buy bigger homes. So if you don't want the rich to get $12,000 in UBI in a way that leaves them $12,000 richer, then just give it to them anyway and get rid of the $30,000 tax subsidy. They'll end up with $18,000 less total annual income, without even touching their tax rates, and they'll be more likely to support the program, because they get money they can hold in their hand just like everyone else.

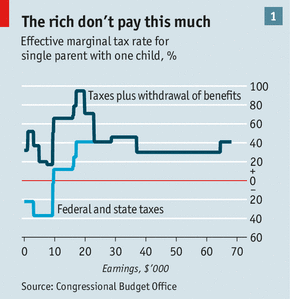

Basically, if your goal is to only help the poor, then an alternative to only giving something to the poor, is to give to everyone and then take it back from the rich. These may sound the same, but they're quite different. It's all about marginal tax rates and errors of exclusion.

The "basic income" for the poor announced by Rahul Ghandi in India appears to be a guaranteed minimum income. A typical GMI sets a threshold and says anyone below this line, we will raise to this line. It's tightly targeted. The result is a marginal tax rate of 100%. What's that mean exactly you may ask?

A 100% marginal tax rate means that given a line drawn at $1,000, someone earning $400 will be given $600. If that same person works twice as many hours to earn $800 instead, they will only get $200 because their need is seen as being half what it was. Their additional $400 earned results in a $400 loss, which is equivalent to a 100% tax on earned income. The benefit for working twice as hard is non-existent.

Put yourself in that position. If no matter how many hours you work, you get a TOTAL monthly income of $1,000, what's the point of earning income through employment? Yes, people will have enough to eat, which is good, and much better than lots of people starving, but what you've just created is a ceiling, not a floor.

Also consider being right on the other side of that qualification line. Say you are earning $1,001. What do you get? Nothing. You get nothing. And all those people doing nothing? They all end up with $1 less than you, the sucker working full-time for basically $1 per month. Would that upset you? Would you really care that no one is going hungry?

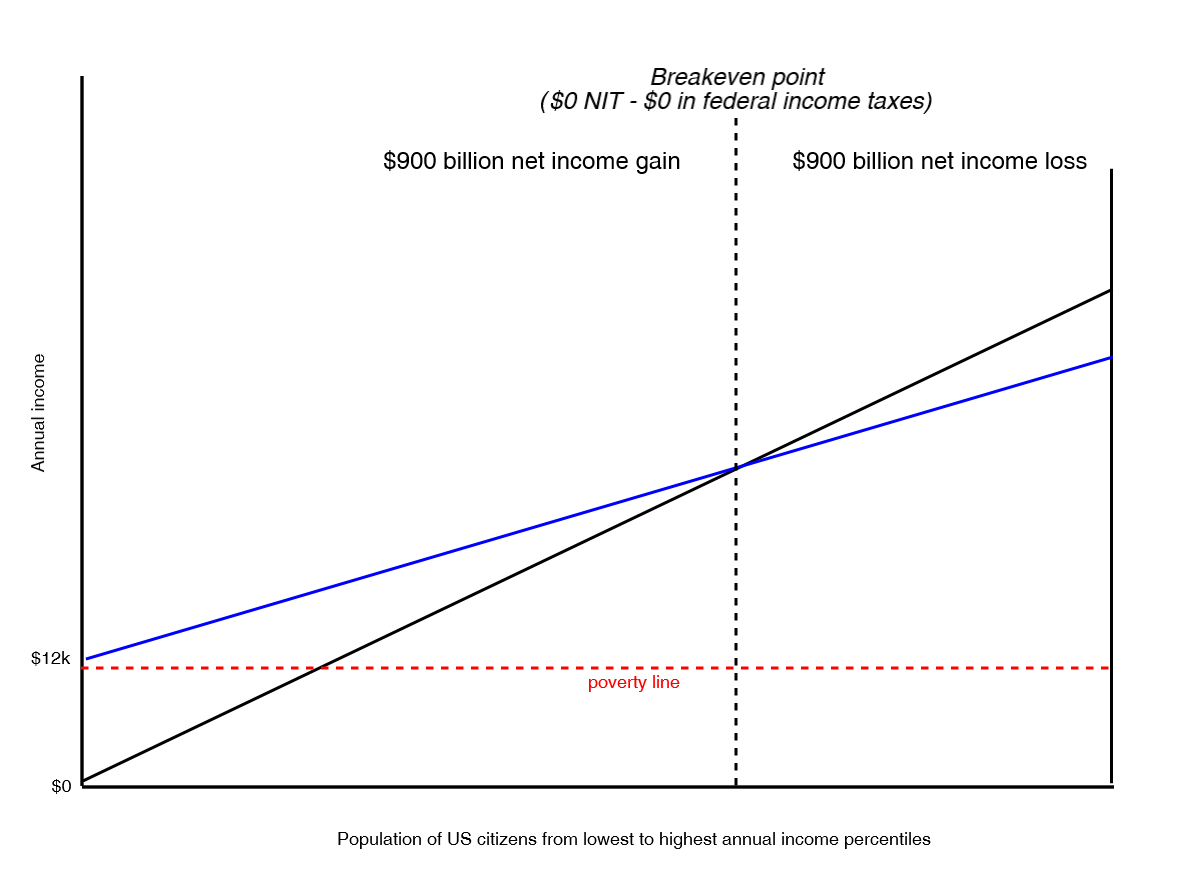

Now, there is another way to go about this that still avoids giving to those who "don't need more money." It involves moving the qualification line into the middle class, and adding a slope so that the marginal tax rate is lowered from 100% to something much more reasonable, like 30%-50%.

Now take the same earlier example of someone earning $400 and the clawback rate is 50% (purely for the sake of simplicity of mental calculations). Someone earning $0 would get $1,000, but someone earning $400 would get an $800 boost, for a new total of $1,200. If they worked to double their earned income to $800, they would get a $600 boost for a total of $1,400.

Notice that now, working to earn more always results in more total income. Again consider the case of earning $1,001. Do you get nothing? No. Your new total income is $1,500.50. You get $500.50, which you can view as a 50% raise. Are you still mad that those earning $0 get $1,000?

This was Milton Friedman's great insight and what was tested in the 1970s in both the United States and Canada. It's called a Negative Income Tax (NIT). It's still targeted, but in a way that's a floor instead of a ceiling. At the very least, India should be talking about this kind of targeting.

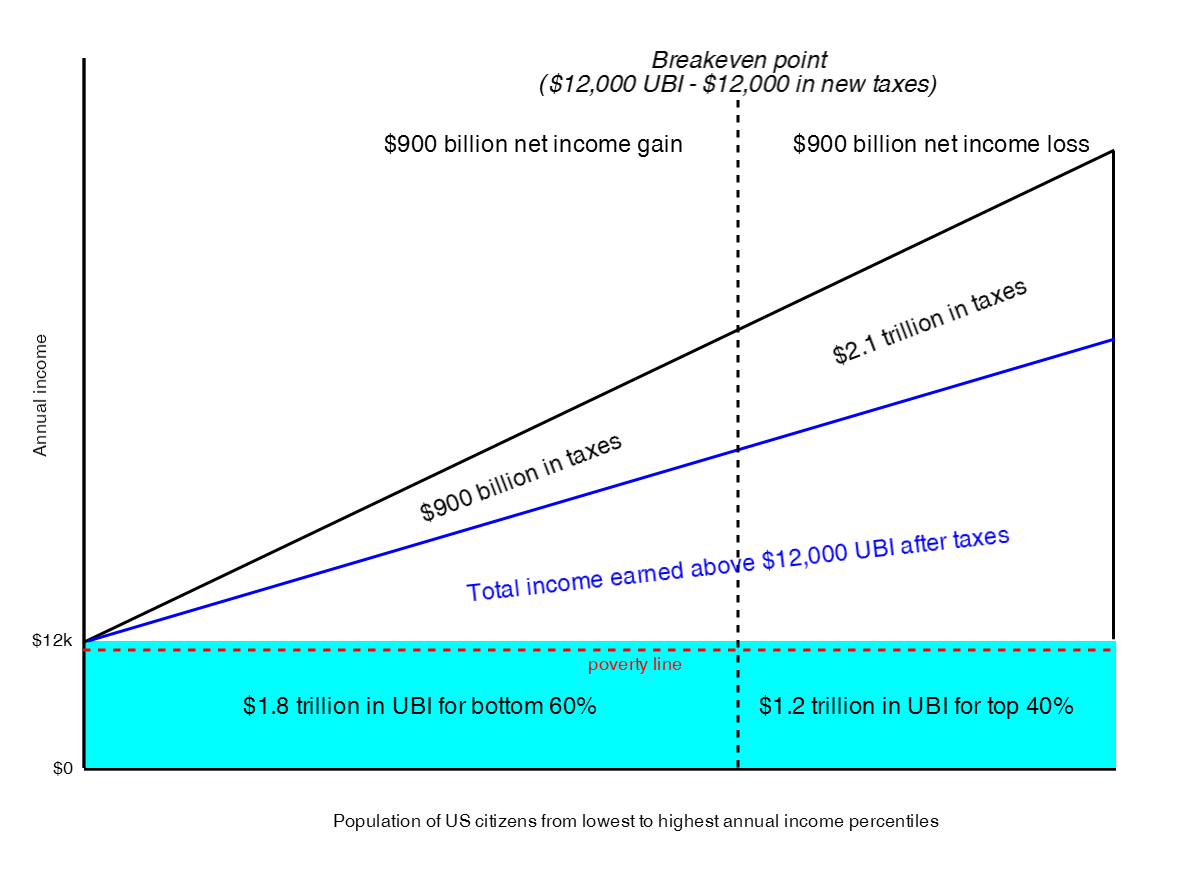

Now what about UBI? The amount of total income can be absolutely identical to the numbers above. For the person earning $400, they could still end up with a total of $1,200 per month, but instead of getting an extra $800, they'd get $1,000 in UBI and pay $200 of their earned income for it.

If they worked twice as much to earn $800, they would get $1,000 in UBI and pay $400 for it, ending up again with a total of $1,400. The person earning $1,001 would still end up with $1,500.50, but they'd get $1,000 in UBI and pay $500.50 for it. The results are all the same. This understanding is frequently missed.

UBI, unlike NIT, requires no monthly calculation. This is important as earned income varies more and more, month by month, for more people. The basic income would be the same every month for everyone, maximizing its dependability for purposes of long-term planning, and the clawback from the rich would be done via the tax code once a year, or through other tax methods than income taxes, like for example consumption taxes , transaction taxes, land value taxes, or Pigovian taxes like carbon taxes. That's where the focus needs to be.

If you're so damn concerned about only the poor getting something, then focus on the tax system, not what you want to give to the poor. It does not cost $1,000 to give someone $1,000 if you increase their taxes by $1,000. It is no different than giving that someone a $1,000 tax credit as a means of reducing their tax burdens as an alternative to lowering their tax rate.

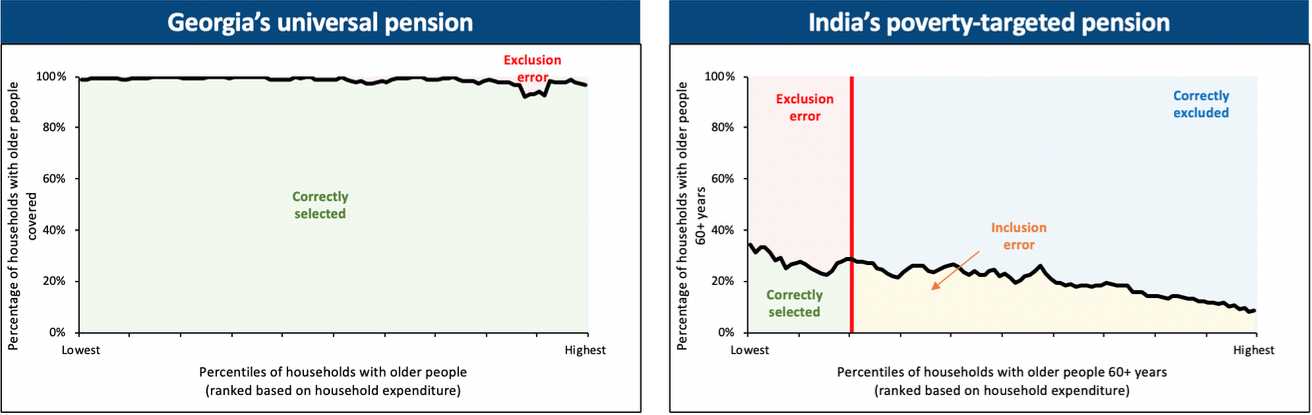

Worry much more about false exclusion than false inclusion. The rich getting money to buy food can be seen as a waste, but those with insufficient incomes not getting money to buy food can be FATAL. The line of determination therefore needs to exist towards the top, not the bottom, and full universality eliminates all false exclusion errors.

Example: Targeting effectiveness of Georgia’s universal pension and India’s poverty-targeted pension

Doing it this way also means creating an incentive to work instead of a disincentive to work. As things are, the highest marginal tax rates are on those who receive something because they are poor. The highest marginal tax rates should be on the rich because they are rich.

Someone who spends $10,000 per month on average to support their lifestyle is not going to stop working to earn $1,000 per month, and as a result have their spending limited to only $1,000 per month. They can already do that and they don't! High marginal tax rates have a much smaller impact on work at the top than the bottom of the income ladder.

With all that said, I'm still excited about how seriously India is considering providing income to the poor, because it's a dramatic improvement to subsidies and benefits-in-kind with work requirements, and because a lot of discussion about fully universal and unconditional basic income is now happening there.

That India is accepting that the solution to poverty is cash is HUGE. It's also huge for the basic income discussion to move from small corners to an entire nation, especially one with 18% of the world's population, and for the discussion to move to policy details instead of just the idea itself.

In conclusion, all of India is not implementing UBI just yet, but I think they're closer than all other nations on Earth right now.

Did you enjoy reading this? Please click the subscribe button and also consider making a monthly pledge in support of my daily advocacy of basic income for all.

_large.jpg)

UBI Guide Newsletter

Join the newsletter to receive the latest updates in your inbox.