Did Spain's B-MINCOME Experiment Prove That Unconditional Basic Income Doesn't Work?

Between 2017 and 2019, in the city of Barcelona, an experiment in the provision of monthly cash happened. It was called B-MINCOME. The original intent of the experiment was to test unconditional basic income to gather evidence for a nationwide universal basic income, but the pilot was put through the wringer of politics and what came out the other side was not so much an innovative new UBI pilot, like the one that was supposed to start this year in Catalonia, but more a test of whether the outcomes of people on welfare improved by making them do certain things or not. There is still something to be learned from the results of this pilot, but it's not the headline result that some UBI opponents are claiming as evidence against UBI. To the contrary, it's all quite pro-UBI as usual.

First, here's the abstract from a recent paper about it published in March 2023:

"While unconditional cash transfers have been studied extensively in developing countries, little is known about their effects in a wealthier context. Through a randomized controlled trial, we study the employment effects of a generous and unconditional transfer targeting low-income families in Spain. Two years into the program, subjects assigned to treatment are 20 percent less likely to work than subjects assigned to a control group. Assignment to an activation plan does not attenuate adverse effects; a more lenient transfer withdrawal rate does. It appears that effects are driven by subjects with children, suggesting substitution of labour for care tasks."

Based on that abstract, without reading the paper, it would be understandable to believe that basic income reduced work by 20%. That seems like quite a finding, right? Well, here's what is not mentioned in the abstract, or in articles I've seen like this and this writing about the experiment: that result is due to a marginal tax rate of 100%. In a big surprise to absolutely no one, it turns out that when you offer someone money, and then take away $1 of that money for every $1 they earn from employment, they are more likely to not work a job, and instead just take the money. That's it. That's the true headline result of a 2-year experiment involving about 1,000 households who on average each received about 500 euros per month — equal to about half the minimum wage there, and about $800 per month in the US based on purchasing power parity.

But that's not all. Here's where things get really interesting, and again, absolutely not reported anywhere, at least anywhere I've seen. The B-MINCOME experiment didn't only test cash with a 100% phaseout rate. It also tested a phaseout rate of 25% on those earning under 250 euros per month, and 35% on those earning over 250 euros per month. This cohort is what could be considered a UBI cohort hit with a 25%-35% surtax as a consequence of the UBI, making it more realistic than a 0% phaseout tax, albeit a bit higher than the 10% to 20% rate I'd recommend.

The B-MINCOME experiment also tested various activation policies like "community involvement" where in addition to the cash, they were encouraged to participate in the social and community life of their neighborhoods, and "social entrepreneurship" where they trained to become social entrepreneurs. Activation was meant to improve outcomes by encouraging people to do things that politicians considered would help people more than just getting money.

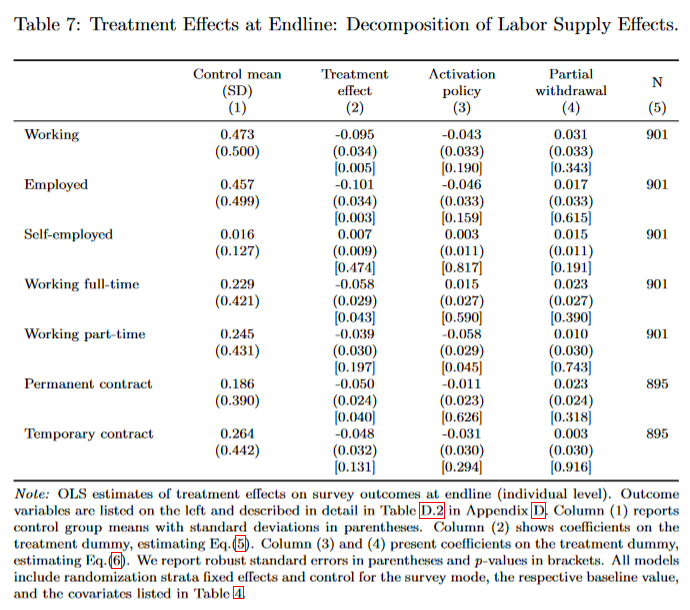

Here's the table from the study analyzing the impacts on work of the main treatment (100% tax), the UBI (labeled partial withdrawal), and the activation policies compared to the control group who got no monthly income.

Here's the translation of the above table into English with my emphasis added in bold:

- Working: The control mean is 0.473, and the treatment effect is -0.095. The Activation policy has an effect of -0.043, and the Partial withdrawal has an effect of 0.031. This suggests that the overall treatment reduces the likelihood of working, while the Activation policy specifically reduces it further. However, the Partial withdrawal has a positive effect, increasing the likelihood of working.

- Employed: The control mean is 0.457, and the treatment effect is -0.101. The Activation policy has an effect of -0.046, and the Partial withdrawal has an effect of 0.017. Similar to the working outcome, the treatment reduces the likelihood of being employed, with the Activation policy having a negative effect, and the Partial withdrawal having a positive effect.

- Self-employed: The control mean is 0.016, and the treatment effect is 0.007. The Activation policy has an effect of 0.003, and the Partial withdrawal has an effect of 0.015. In this case, the treatment increases the likelihood of being self-employed, with both the Activation policy and Partial withdrawal having positive effects.

- Working full-time: The control mean is 0.229, and the treatment effect is -0.058. The Activation policy has an effect of 0.015, and the Partial withdrawal has an effect of 0.023. The treatment reduces the likelihood of working full-time, but the Activation policy has a positive effect, and the Partial withdrawal also has a positive effect.

- Working part-time: The control mean is 0.245, and the treatment effect is -0.039. The Activation policy has an effect of -0.058, and the Partial withdrawal has an effect of 0.010. The treatment reduces the likelihood of working part-time, with the Activation policy having a larger negative effect, while the Partial withdrawal has a positive effect.

- Permanent contract: The control mean is 0.186, and the treatment effect is -0.050. The Activation policy has an effect of -0.011, and the Partial withdrawal has an effect of 0.023. The treatment reduces the likelihood of having a permanent contract, with the Activation policy having a negative effect and the Partial withdrawal having a positive effect.

- Temporary contract: The control mean is 0.264, and the treatment effect is -0.048. The Activation policy has an effect of -0.031, and the Partial withdrawal has an effect of 0.003. The treatment reduces the likelihood of having a temporary contract, with the Activation policy having a negative effect, and the Partial withdrawal having a negligible positive effect.

In summary, the non-UBI treatments generally seem to have a negative impact on labor supply outcomes, with the activation policy often having a more significant negative effect. However, the "partial withdrawal" mimicking a UBI plus accompanying taxes often has a positive effect on these outcomes, even counteracting the negative work impacts of activation policies.

That's right, UBI resulted in across the board positive impacts on work compared to the control group, and paternalistic activation policies led to mostly worse work outcomes. Whereas the headline result showed a 20% decrease in paid work, the UBI+tax cohort saw a 6.5% increase in paid work. Where the welfare with a 100% marginal tax rate saw a 25% decrease in full-time employment, those provided UBI with a 25%-35% phaseout tax saw a 10% increase in FT work. In regards to self-employment, those provided UBI+tax were twice as likely (94%) to become self-employed as those in the control group.

Table 8 of the study examined household impacts. There, the researchers found that whereas the 100% tax reduced the number of workers in a household by 18%, the 25%-35% phaseout tax did not, and whereas the 100% tax made a household 14% more likely to have zero people doing paid work, the 25%-35% phaseout tax only made a household 2% more likely to have zero people doing paid work.

Now, someone may look at that, and decide that the UBI condition did have at least one negative impact on paid work, but on further examination, it turns out that this reduction was really only among parents of young kids choosing to care for their kids at home for free instead of paying for child care.

"The results of a heterogeneity analysis suggest that adverse employment effects are driven by households with care responsibilities. While employment effects are largely absent among households without children, they are sizeable and negative among households with children living at home. Hence, a potential mechanism explaining our results may be substituting labor for care tasks."

When looking at those in the experiment without kids, who were provided welfare with a 100% phaseout rate, it reduced the probability of paid work by the main recipient by as little as 0.3 percentage points. But when looking at those in the experiment with kids under age 14, that's where the impact was found. So it's pretty clear that what's happening here is that virtually the entire negative impact on employment is operating through parents with young kids not working less, but working for free at home as care providers. That work by the way subsidizes a lower cost of child care for everyone else. As I've written before, the impact is Pigovian, meaning that society benefits by subsidizing that kind of work.

I think it's also important to note that this study didn't look at hours worked or impacts on income. It only looked at whether people were working for an employer, self-employed, full-time employed, or part-time employed. Leaving out hours means that someone could have been working two hours per week and decided it wasn't worth it when provided income. That's quite different to overall productivity than someone working 60 hours per week deciding not to work. And if someone working 60 hours decided to work 40 hours instead, that wouldn't show as an impact in this study despite the 20-hour reduction, because they were still working full-time, and this study didn't look at impacts on income.

Finally, and this is a big asterisk for everything you've just read, the authors of the study concluded after adjusting the p-values using the Westfall and Young (1993) methodology, that most of the results became insignificant, with only the welfare with a 100% phaseout tax being marginally significant in its impact on the number of members in a household working.

In other words, basically take this entire study with a grain of salt, except for the quite obvious takeaway that it's really stupid to provide people with income and then tax it away at a 100% rate. And anyone who knows anything about universal basic income, and is being honest and forthright, knows that welfare with a 100% phaseout rate is most certainly not universal basic income.

For additional reading about the B-MINCOME experiment, you may also find this paper by Leire Garcia interesting. There are some other lessons to be learned about UBI pilots in general. From the conclusion of her paper:

"The intriguing question is, why pilot projects, despite achieving favourable results and being launched by UBI advocates, fail to generate meaningful policy and political impact? This qualitative case study of the B-Mincome pilot project has identified some of the key factors influencing this process, but, taking a broader look at Spanish and Catalan politics, has shown that unexpected factors may end up activating a debate much more effectively than a pilot project... Overall, political analysis of the B-Mincome project suggests that this experiment, rather than having political consequences, was the consequence of politics."

For additional research about the impacts of UBI on work, I also suggest reading this peer-reviewed systematic review of studies published in late 2020.

"Over 1200 documents that discuss the UBI/employment relationship have been reviewed. We found a total of 50 empirical cases, of which 18 were selected, and 38 studies with contrasted empirical evidence on this relationship. The results speak for themselves: Despite a detailed search, we have not found any evidence of a significant reduction in labour supply. Instead, we found evidence that labour supply increases globally among adults, men and women, young and old, and the existence of some insignificant and functional reductions to the system such as a decrease in workers from the following categories: Children, the elderly, the sick, those with disabilities, women with young children to look after, or young people who continued studying. These reductions do not reduce the overall supply since it is largely offset by increased supply from other members of the community."

Note: The prompt I used in Midjourney for this article's title image was: "a laboratory with a scientist experimenting with cash. there are stacks of dollar bills around and the scientist is looking at money under a microscope. the lab is full of scientific tools and beakers and devices. there is a window in the room. outside the window is Spain. --v 5 --ar 3:2"

Do you want more content like this? Please click the subscribe button and also consider making a monthly pledge in support of my perpetual UBI advocacy.

Special thanks to my monthly supporters on Patreon: Gisele Huff, Haroon Mokhtarzada, Steven Grimm, Matthew Cheney, Katie Moussouris, Tricia Garrett, Zack Sargent, David Ruark, Larry Cohen, Liya Brook, Frederick Weber, John Steinberger, CanadayVibes , Kerry Bosworth, Laurel gillespie, Dylan J Hirsch-Shell, Tom Cooper, Michael Tinker, Judith Bliss, Robert Collins, Daryl Smith, Joanna Zarach, ace bailey, Daragh Ward, Albert Wenger, Andrew Yang, Bridget I Flynn, Peter T Knight, David Ihnen, Max Henrion, Elizabeth Corker, Gray Scott, Gerald Huff, Albert Daniel Brockman, Michael Honey, Natalie Foster, Joe Ballou, Chris Rauchle, Arjun , chris heinz, Pavel S, Zachary Weaver, Juro Antal, Herb, Justin Seifert, Jodi Sarda, Rosa Tran, Deanna McHugh, Ryan Ash-Miller, miki, Adam Parsons, bradzone, Lee Lor, Akber Khan, John Sullivan, Team TJ, Yang Deng, Yan Xie, Marie janicke, engageSimply - Judy Shapiro, Phuong Truong, Garry Turner, Tim , Warren J Polk, Timothy P O'Connor, Jeffrey Emmett, Stephen Castro-Starkey, Oliver Bestwalter, Kev Roberts, Walter Schaerer, Loren Sickles, anti666, Eric Skiff, Thomas Welsh, Kai Wong, and Laura Ashby. Become a monthly patron to see your name here too.

_large.jpg)

UBI Guide Newsletter

Join the newsletter to receive the latest updates in your inbox.