The FairTax Would Implement a Universal Basic Income

Anyone who supports the FairTax and its monthly 'prebate' also supports UBI even if they swear otherwise

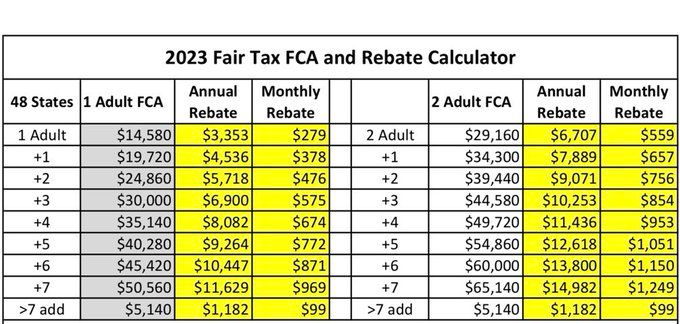

Basic income. $279 every month. Tax free money from the government. No work requirements. No income-testing. For every legal resident of the United States, every month, with additional income for kids depending on number of kids.

That's the fully universal basic income that the Republican FairTax Act proposes that the ultra-conservative Freedom Caucus of the House wants to pass into law as a truly massive reform of our tax system. The UBI is called the Family Consumption Allowance, and referred to in general as a "prebate," but call it whatever you want, it's a UBI. And the only reason it's even being talked about is because some far-right members of Congress demanded that the FairTax get a vote as part of the deal Kevin McCarthy agreed to in order to become House Speaker.

In this post, I'm not going to get too deep into the details of the tax side of the Fair Tax, and the implications of replacing our entire income tax system with a consumption tax. There's plenty of other content out there about that. What there isn't a lot of content about is the UBI it proposes, so that's what I want to focus on.

First, why is there a universal unconditional basic income as part of the FairTax? It's a side-effect of replacing income taxes with a consumption tax. Right now, we have an income tax system that's paired with a standard deduction of $12,950 in 2023. This means that someone who earns $12,951 would only be seen as having $1 of taxable income. The intent of the deduction is to not tax people in poverty.

So what happens when a national sales tax makes everything cost more? Well, those people not paying income taxes, because they're in poverty, would suddenly be in even greater poverty thanks to being able to buy less stuff with the same amount of money. Poverty would increase in America in a very dramatic fashion with a national sales tax alone. That's where the Family Consumption Allowance comes in. The thinking is that if we add a sales tax to everything, we need to rebate that tax to those in poverty. That's how the amount of the prebate is calculated.

The federal poverty line in 2023 is defined as $14,580. The FairTax proposes to tax 23% of the total price (tax inclusive) of all retail prices, so in order to not hit people below the poverty line with the tax, everyone would need to get an amount of money that is equal to 23% of the federal poverty line. That's $3,353. Because everyone needs money to buy what they need on a monthly basis, then that's $279 each and every month. Because the federal poverty line varies according to household size, the larger the household, the more money to afford higher prices.

I should note here though that the prebate amount should actually be $365 per month because the FairTax seeks to impose a new 30% tax, which means that the total tax imposition at the federal poverty line would be $4,374. That's the amount that is 23% of $14,580 + $4,374. I have no idea what their reasoning is here to not do that. It could be a mistake based on the confusion of saying the tax is 23% of the price plus the tax instead of 30% of the price alone, or it could be a matter of leveraging that confusion to lowball the amount of the prebate.

So that's where the amount of $279 a month comes from. But why give the money to everyone instead of only those with lower incomes? Because the plan is to get rid of the IRS. Without the IRS, the government will no longer track people's incomes. The government will not know how much money anyone is making, so there's no way to do any income testing. Instead, the Social Security Administration would send the money based on what they know about who has a Social Security number, and people would only be required to register each year with the "sales tax administering authority" in the state in which they reside.

Also this is already how things currently work with the standard deduction. Everyone gets the standard deduction. You can be a billionaire earning hundreds of millions of dollars a year and you can claim the standard deduction. Although most billionaires don't because they can also choose to get an even larger tax deduction by itemizing deductions, but the fact remains, no one pays any income taxes on earnings below the amount of the standard deduction. It's universal.

Because the Fair Tax would replace all income taxes, that includes ending the standard deduction, and because there's no way of knowing people's incomes without an IRS, there needs to be an amount of money that goes to everyone as an income floor to afford the tax hike on spending up to the poverty line. And thus the result is a small unconditional basic income.

The logic may be to rebate the sales tax on the amount of stuff people below the poverty line buy, but the result is to provide people an income without any means-tests or work requirements. If someone can figure out how to live on $279 a month, then someone can do that. No employment required. It's a basic income.

For a married couple, it's a combined income of $558 a month. The excuse to provide that income is a sales tax rebate, but the fact remains that it's enough to pay for food without working for food. So anyone who supports the Fair Tax and its prebate is not opposed to the idea of an unconditional basic income. However small the floor would be, they support a fully unconditional and universal income floor that starts at $279 a month vs today's $0 a month.

If you've read this far, as a progressive, maybe you're thinking this actually sounds kind of interesting, and as a conservative, maybe you're thinking this actually sounds less interesting than you thought, but here's where I'll mention a couple other things I think people should know about the FairTax plan besides the UBI.

What FairTax advocates don't really advertise is the fact that besides the standard deduction which the FairTax UBI would essentially replace, there are also programs like the child tax credit (CTC) and earned income tax credit (EITC) that would also be ended, and go unreplaced. So right now, some people are not only paying zero taxes, but are also getting income from the government each year from the IRS. Whereas the FairTax proposes to not tax people in poverty just like income taxes don't tax people in poverty, the income tax system also helps reduce poverty through refundable tax credits.

This means that some people currently in poverty or near poverty currently receiving CTC and/or EITC payments would absolutely be worse off with the FairTax even with the monthly prebate. The average amount of EITC received in 2021 was $2,411, and the CTC reduces taxes by up to $2,000 per kid. The FairTax doesn't try to replace any tax expenditures except for the standard deduction. This is true not only for the poor, but also the middle class. Middle class households who itemize their deductions currently enjoy the home mortgage interest deduction among other deductions. All those deductions would disappear too.

So on the one hand, people pay more for stuff with a FairTax, and on the other, people get a small UBI and get to potentially keep more of their paycheck when payroll taxes are eliminated, but there are definitely winners and losers depending on the tax subsidies people are currently enjoying but not recognizing as government assistance because it's in the tax code as credits and deductions.

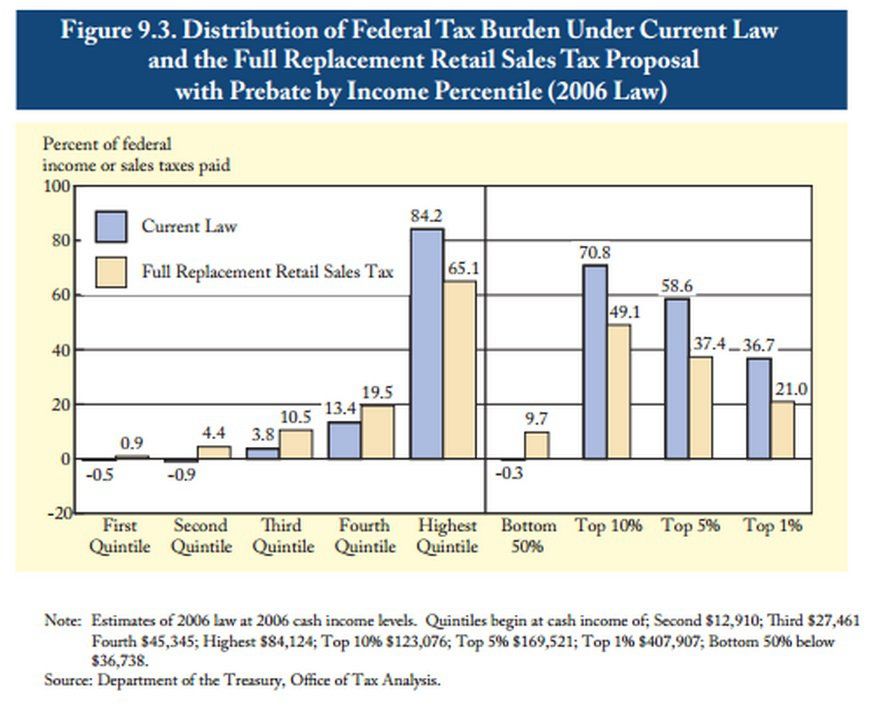

There's also the issue of ending a progressively-tiered tax system with a consumption tax. Right now, low-income earners pay less than the FairTax would tax them, even with the prebate, and high-income earners pay more than the FairTax would tax them, so it's likely that the FairTax would be an overall regressive reform that would further increase inequality. Eliminating the estate tax would be a hugely regressive reform. There is no estate tax at all on estates worth less than $13 million. No one is paying that tax except the richest 1%.

This is also why George W. Bush considered and rejected the idea when he was president. His administration's analysis found that even with the small UBI, the entire bottom 80% of Americans would end up carrying a higher percentage of the total national tax burden. Only the richest 20% would see a decreased overall tax burden.

The small print of the FairTax plan also includes the fact that the 23% sales tax is only for one year (and is actually a 30% rate because it would add a $30 tax to a $100 product, but they say 23% because $30 is 23% of $130). After that it would be decided on a year-to-year basis based on what it's determined that Social Security and Medicare will require on top of a general revenue rate of 14.9%. This makes it extremely likely that the national sales tax would be cranked up after the first year, potentially as high as 60% to achieve the goal of revenue neutrality.

Now, I don't want to be accused of leaving out potentially positive impacts of replacing our current tax system with the FairTax, besides the small UBI, so I also should mention that it's certainly theoretically possible that ending corporate taxes could mean lower prices should corporations choose to use their tax cut to lower prices instead of make larger profits. Seriously though, who are we kidding about the realism of that considering the spectacular amount of record profits being taken recently in an inflationary environment where corporations could raise prices more than the impact higher inflation was having on them under the cover that higher inflation provided them.

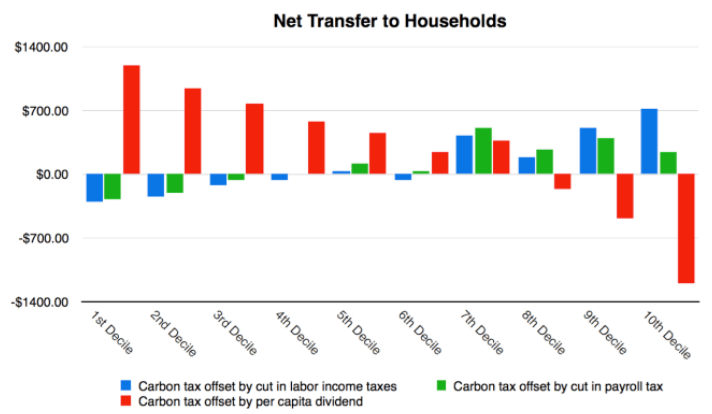

Another thing I want to mention is just how similar a national sales tax and prebate would be to a carbon tax and prebate, in terms of making stuff cost more but rebating that extra cost back to consumers. However, where the FairTax looks to replace all existing federal taxes, a carbon tax would be a new tax that's only meant to fund the rebate, which would also be a UBI if fully universal. Under a deficit-neutral carbon fee and dividend policy, about two-thirds of low- and middle-income Americans would see a net increase of disposable income, while most of the richest would see a net decrease of disposable income. So where the FairTax and prebate would be a regressive change that increases inequality, a carbon tax and prebate would be a progressive change that reduces inequality.

Analysis of a carbon tax and prebate also shows that returning the money universally would be the better way of going about it than reducing payroll taxes or income taxes. By refunding 100% of the carbon tax to all Americans equally, the result would be an overall tax cut for the bottom 70% of households, whereas using the carbon tax revenue to lower income taxes would hurt the bottom 60%, and using it to lower payroll taxes would hurt the bottom 30%.

The details definitely matter when it comes to pairing consumption taxes with universal basic income. Personally, I think if we're going to purposely make stuff more expensive, the stuff we make more expensive should be stuff we want less of, and if we're going to implement UBI, it would be best to view the UBI as an income tax rebate that lowers most people's overall income tax burdens, and design it in a way that reduces both poverty and inequality. And if we're going to make everything more expensive, we should be realistic about tax avoidance and look to implement an automated payments tax on all electronic transactions or a value-added tax as Andrew Yang proposed instead of a national sales tax. It's so much easier to avoid a tax that only hits at point-of-sale at the very end of the value-add chain, instead of throughout the entire consumption chain on every sale.

In conclusion, I love how the FairTax includes a UBI. It absolutely needs it in order to have any chance at all of not increasing poverty and inequality, but the FairTax as proposed is not going to happen, and even if it had a real chance, it would likely reduce the consumption power of everyone except the top 20%. It's also pretty weird how the FairTax has its origins inside the Church of Scientology who lost interest in it after they gained their tax-free status, but that origin doesn't change what it would or wouldn't do if enacted. What I really want people to walk away with after reading this is that anyone who supports the FairTax Act also supports UBI, which reinforces what I've been saying for a decade now - that UBI is indeed not left or right. It's simply money to spend in free markets. It's just a monthly consumption allowance to afford basics like food, just like the FairTax proposes.

Do you want more content like this? Please click the subscribe button and also consider making a monthly pledge in support of my ongoing UBI advocacy work.

Special thanks to my monthly patrons: Gisele Huff, Haroon Mokhtarzada, Steven Grimm, Matthew Cheney, Katie Moussouris, Tricia Garrett, Zack Sargent, Larry Cohen, Frederick Weber, CanadayVibes, Kerry Bosworth, Judith Bliss, Laurel Gillespie, Dylan J Hirsch-Shell, Tom Cooper, Michael Tinker, Robert Collins, Daryl Smith, ace bailey, Daragh Ward, Andrew Yang, Bridget I Flynn, Peter T Knight, David Ihnen, Myles McLane, Elizabeth Corker, Gray Scott, Gerald Huff, Albert Daniel Brockman, Michael Honey, Natalie Foster, Joe Ballou, Chris Rauchle, Arjun, Chris Heinz, Pavel S, Zachary Weaver, Juro Antal, Herb, Justin Seifert, Jodi Sarda, Rosa Tran, Deanna McHugh, Ryan Ash-Miller, miki, Adam Parsons, bradzone, Lee Lor, Akber Khan, John Sullivan, Team TJ, Yang Deng, Yan Xie, Marie janicke, Iggy C, engageSimply - Judy Shapiro, Phuong Truong, Tim , Warren J Polk, Timothy P O'Connor, Jeffrey Emmett, Stephen Castro-Starkey, Oliver Bestwalter, Kev Roberts, Walter Schaerer, Loren Sickles, anti666, Eric Skiff, Thomas Welsh, and Kai Wong.

_large.jpg)

UBI Guide Newsletter

Join the newsletter to receive the latest updates in your inbox.