How Money is Born out of Public Spending and Dies by Taxes

If there's one thing most people don't seem to understand about how money works that I think would really help governments work better in the 21st century, it's that money does not flow in the way we perceive it does. It's an illusion. What money actually does is pop into and out of existence in a way that looks like flow. In this post I will try to sufficiently explain that singular understanding of money.

Okay, so you want to start your own country and create your own currency? Congratulations! What's step one? Is it to tax your people? How are you going to get them to pay taxes in a currency that doesn't exist yet? Step one therefore is to create money out of nothing. Choose whatever you want. Want to use shells? Okay. Want to carve notches on rocks or sticks? Okay. Want to use dollar bills? Okay. Want to use ones and zeroes? Okay. Whatever you do, get that stuff to your people. After your people have money, tax some of it back. Don't tax all of it back. That would leave nothing for them to use on goods and services in the private sector. Tax some percentage of it back. Congrats! You just ran a "deficit", began your "national debt", and gave your money value by requiring that people pay their taxes in your currency.

Now, what comes next is what really trips people up. Let's say you want a new bridge built. Where does the money come from to pay people to build that bridge? Does it come from the taxes you just collected? No. Not as the currency issuer. As the currency issuer you are not limited to first taxing your people in order to spend. You can just spend. Remember, you have the power to create money. No one else but you in your country has that power. Everyone else needs to acquire money first in order to spend it. People do. Businesses do. Cities do. States do. Countries without their own currencies do. You however do not. You just create and spend money. So create the money and use it for your bridge.

Don't believe me? Listen for yourself to former Federal Reserve Chairman Ben Bernanke talk about how when the government pays for things, it's “not taxpayer money," and they "simply use the computer to mark up the size of the account.”

One caveat to money creation is that the money you create and spend into existence will increase the total supply of money and therefore have some amount of inflationary pressure. So you need to tax money out of existence after spending in order to avoid expanding the money supply too much and creating excessive inflation you don't want. This means if that bridge is going to cost $1 million YouBucks to be built, you may want to tax your nation somewhere around $1 million to avoid inflating your money supply. That's pretty much the main purpose of taxes aside from giving money its value and nudging behavior. You don't have to tax first in order to build your bridge. You can just spend the money that building the bridge needs. What actually matters most to building a bridge is if you have the ability to build the bridge. Do you have the materials for it, and the people with the skills necessary to build it, and the time and technology it will take to build it? Those things are what actually matter, not "funding it with taxes."

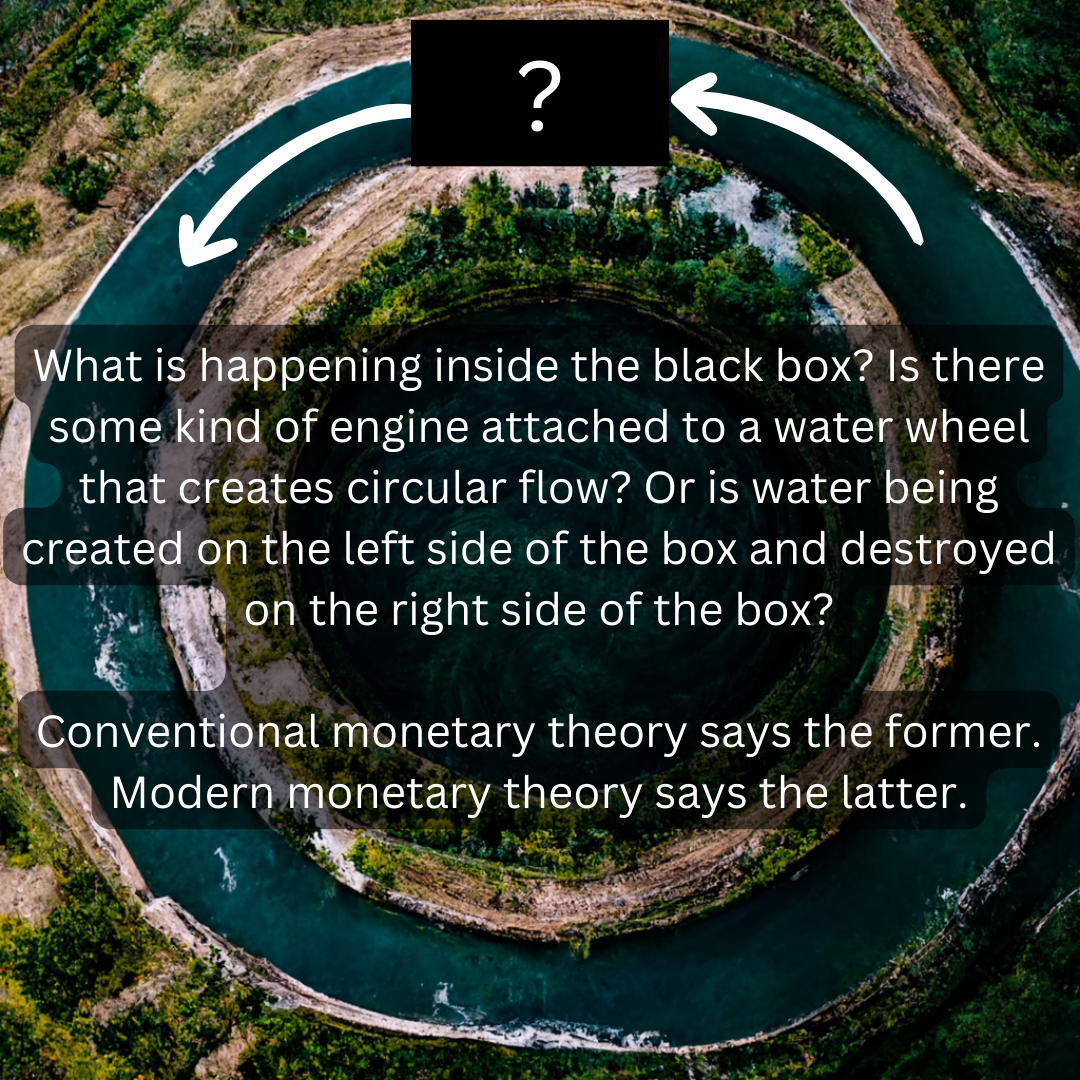

Consider a circular river with a counterclockwise flow and a structure covering part of the river. You don't know what's inside the structure. It's like a giant mystery box. It's fair to assume though that whatever is going on inside the structure is what's causing the river to flow around and around in a circle.

It's completely rational to think that what must be causing the water to flow around and around is some kind of device that you can't see underneath the black box that's physically moving the water. Maybe a big water wheel is there and it's physically applying a force to create the river current. The amount of water in the river stays the same. It's just something is moving that water around and around.

That's how people think money works. We have these things called dollars that we physically hand to each other. The dollars are real. They don't disappear and reappear when they change hands. They continue existing and they just move from one person to another. That's how we experience money, so that's how we think money works. But that's not the way it works at the national or bank level.

At the national level, what's really going on is that all the money coming out of the government is brand new money. All of it. And the money that looks like it's going back to the government to be spent again is just being deleted. When you pay your taxes, the government just erases money from your bank account. Poof. Gone. Water exits one side. Water enters one side. As long as the river doesn't overflow, the illusion is maintained of water going around and around. But it's just an illusion. The water is being created and destroyed.

This is all especially true with digital money like most of us now use. When we use a debit card and on our end a one flips to a zero, and on the other end a zero flips to a one, no tangible thing went anywhere. Money disappeared in one place and appeared in another as if by magic. But it's not magic, it's just a ledger, and the numbers can be anything. The numbers are just numbers. It's what we can buy with the numbers that really matters.

Banks also have the ability to create money through what's called fractional reserve lending, but the money that banks create is out of private debt. That money is then destroyed when the debt is paid back. This is also why when the Fed wants to reduce inflation, it makes it more expensive to get loans via higher interest rates. People don't want to pay higher interest rates so they take out fewer loans which reduces the amount of money out there in the economy to spend on stuff that banks would have otherwise created through lending. Whenever you use a credit card, you're spending brand new money that inflates the money supply. When you pay your credit card bill, you're destroying money and shrinking the money supply.

Another fun way to look at it is like teleportation in science fiction. Are you being converted to energy and sent somewhere at lightspeed to be reconverted back into yourself? Or do you die when you step into a transporter, and an exact copy of you is recreated at the destination point? It's kind of a Ship of Theseus question. Spock's opinion on this was to say, "a difference that makes no difference, makes no difference." I think it does make a difference though when it comes to money.

It's easy to see why all this is confusing, because of how similar it looks, and how silly it can sound to point out. If a country is spending and taxing $1 trillion a year, it can look like it's taxing $1 trillion and then spending $1 trillion instead of spending $1 trillion and then taxing $1 trillion. And that's exactly what's happening when a government doesn't have its own currency. But when a government has its own currency, it's actually creating $1 trillion and then erasing $1 trillion.

It may sound really silly to point such a distinction out. Who cares, right? What's the difference between taxing and then spending versus spending and then taxing, especially when the amounts are identical? Even if one is more true than the other, why does it matter? It matters because a country with its own currency that thinks it has to come up with taxes first in order to spend is far more likely to think in terms of money limits instead of economic capacity and resource limits. That leads to all kinds of nonsense like "budget ceilings" and fretting over any amount of taxes that is less than spending, which then leads to destructive policy choices like austerity and increased poverty which costs us trillions of dollars worth of wasted resources on the downstream impacts like worse health and more crime.

We hear things like: "Oh no! We spent more on Social Security than we taxed. I guess we need to cut Social Security now." Who cares if that means seniors will experience more hunger despite there being plenty of food. We have to do that because we just don't have enough tax money, right?

It's nonsense. It's all nonsense. If your country has enough food for everyone, and you create your own money, then nothing is preventing you from distributing enough money for everyone to buy the food that there's plenty of. There's no physical constraint on that food. There's no physical constraint on the money. The only constraint is the choice to not issue the money for food. It's a political choice.

Do you see now why it's so important to stop thinking in terms of money and instead begin thinking in terms of actual economic capacity constraints? If your country has plenty of food for everyone, then you can get money to everyone to buy the food without food inflation. If your country does not have enough housing in places where people want to live, then you need more housing built where people want to live if you want to avoid higher rents from distributing money for housing. If your country wants to have an abundance of clean sustainable energy, then invest in more clean sustainable energy. In the long run, it's going to be a heck of a lot cheaper to use an unlimited resource like the sun or wind than a limited resource like fossil fuels. Not enough electric cars for everyone who wants one to have one? There could be higher prices on electric cars, temporarily, if you distributed money, that is until electric car manufacturers are able to ramp up production to meet the higher demand. Always consider supply constraints when going about money creation as a currency issuer. Supply of stuff is the real constraint on spending, not the money to buy stuff.

Another reason it's important to understand your economy's real limitations is to avoid thinking you're not going to surpass them because you think you taxed the money first to pay for something. Here's what I mean by that. Let's say that from a spending perspective you need to spend $1 million on something. From a tax-first perspective, you first need to come up with $1 million, and because money is money and money is your perceived constraint, you decide to tax one person $1 million. No one else pays the tax. You're all set, right? No, you're not.

If all you do is reduce the spending power of one person, then you could surpass your capacity constraints. A rich person tends to not buy millions of pillows, so if you're worried about surpassing pillow capacity constraints, taxing one person isn't going to help. However, if you taxed 10,000 people $100, or 100,000 people $10, or 1 million people $1, that may make it so you don't surpass your resource constraints. This is why wealth taxes don't make all that much sense from an economic capacity view compared to something like a small consumption tax. A tiny tax that hits many versus a large tax that hits a tiny few isn't going to have the same impact on inflation even if they're measured as being the same amount of dollars. This isn't to say that wealth taxes are a bad idea, just that they aren't going to reduce inflation as much as taxes that a lot more people pay. There's other valid reasons to do wealth taxes like reducing inequality.

Here's something else that leads directly from a better understanding of how fiat money and taxes work. If you see taxes as necessary to pay for things, then you'll only ever pay for things with taxes, which will limit your actual potential capacity. If you understand that taxes are only one way of avoiding exceeding your inflation constraints, then you'll also see that there are things you can do to avoid exceeding your inflation constraints that aren't taxes, and that therefore can reduce existing taxes or allow for increased spending with the same taxes and no inflation.

Let's say in your country you founded, there are two companies working in cahoots with each other to set the price of what they sell instead of competing against each other. Because of this, they each have agreed with each other that the price of beef is $20 a pound. But what if you enforced competition and said they either need to compete or be hit with huge fines or even ultimately lose their ability to sell beef to your people? If the price of beef then went down to $5 a pound, you just reduced inflation without doing any taxing at all.

Because your real constraint is economic capacity, if you gave your people money to afford beef in a price-fixing situation, it's possible you would have exceeded your capacity constraints as people spent more money on other things than beef. One way to avoid this is through taxes to reduce the amount of money spent on other stuff. But because another way to avoid inflation is competition, now that money you provided that would have otherwise led to some inflation did not, and you didn't need to raise any taxes. So therefore, you can "pay for" stuff without taxes by just spending the money and making smart policy choices that expand your economy's capacity to meet demand with supply.

I hope money and public spending and taxes makes a bit more sense now. When you can see money as just a thing we create out of nothing, and delete with taxes, it's easier to see that what really matters is all the real stuff we can't create out of nothing. It's easier to see that taxpayers aren't funding government. They're contributing to inflation reduction and currency value maintenance. It's easier to see that some taxes are better than others despite resulting in equal amounts of dollars taxed, and it's easier to see that we can deploy tools other than taxes in order to reduce inflation.

I hope it's also easier to see how truly ridiculous it is to believe as an issuer of currency that you can't afford to pay for what you already promised to pay for, especially when it's spending to increase capacity (like infrastructure) or to free up capacity (like reducing the massive resource burdens of poverty, especially child poverty). Looking at you, debt ceiling supporters.

So the next time someone asks, "But how are we going to pay for it?" about anything at all, perhaps you'll find this post useful in formulating a reply. Of course another option is reading my book, Let There Be Money which covers much more.

Do you want more content like this? Please click the subscribe button and also consider making a monthly pledge in support of my ongoing UBI advocacy.

Special thanks to: Gisele Huff, Haroon Mokhtarzada, Steven Grimm, Matthew Cheney, Katie Moussouris, Tricia Garrett, Zack Sargent, Larry Cohen, Frederick Weber, CanadayVibes, Kerry Bosworth, Laurel Gillespie, Dylan J Hirsch-Shell, Tom Cooper, Michael Tinker, Judith Bliss, Robert Collins, Daryl Smith, Joanna Zarach, ace bailey, Daragh Ward, Albert Wenger, Andrew Yang, Bridget I Flynn, Peter T Knight, David Ihnen, Myles McLane, Max Henrion, Elizabeth Corker, Gray Scott, Gerald Huff, Albert Daniel Brockman, Michael Honey, Natalie Foster, Joe Ballou, Chris Rauchle, Arjun, chris heinz, Pavel S, Zachary Weaver, Juro Antal, Herb, Justin Seifert, Jodi Sarda, Rosa Tran, Deanna McHugh, Ryan Ash-Miller, miki, Adam Parsons, bradzone, Lee Lor, Akber Khan, John Sullivan, Team TJ, Yang Deng, Yan Xie, Marie janicke, Iggy C, engageSimply - Judy Shapiro, Phuong Truong, Tim , Warren J Polk, Timothy P O'Connor, Jeffrey Emmett, Stephen Castro-Starkey, Oliver Bestwalter, Kev Roberts, Walter Schaerer, Loren Sickles, anti666, Eric Skiff, Thomas Welsh, and Kai Wong.

_large.jpg)

UBI Guide Newsletter

Join the newsletter to receive the latest updates in your inbox.