Inequality and the Basic Income Guarantee

This essay is part of a collection of 37 from the Wicked Problems Collaborative of which I’m part, titled “What Do We Do About Inequality?” The book is available on Amazon in Kindle and paperback formats.

The use of cash transfers as a tool for reducing poverty and inequality is not a new policy, nor are the positive social effects limited to these issues alone, with additional observed effects on a vast array of dimensions like nutrition, entrepreneurship, economic multipliers, economic stability, social cohesion, and more. It is because of this solid and growing evidence for such effects, that in recent years, cash transfers have been becoming increasingly implemented worldwide. Calling this growth exponential in its 2014 report on The State of Social Safety Nets, the World Bank described conditional cash transfer (CCT) programs as having doubled since 2008 and unconditional cash transfer (UCT) programs as having doubled since 2010.

The efficiency of cash transfer programs is also widely known among economists. According to the chairman of the economics department at Harvard University, as far as policy propositions with greatest consensus among professional economists go, 84% are in agreement that cash payments increase the welfare of recipients to a greater degree than do transfers-in-kind of equal cash value. And yet case after case of the economic efficiency of cash transfers somehow continues to surprise or confound the public at large, as people continue to insist instead on transfers in-kind and attached conditions despite the evidence of observed human behavior where cash is given with no conditions. This continuing misinformation trend seems likely related to media bias and long perpetuated myths by those looking to exploit popular assumptions for their own gain.

There is one idea however, that although not new in itself, is rapidly experiencing a renaissance of renewed interest. It is this idea and its growing potential to be carried forward as a mass social movement that warrants its own discussion regarding its potential impacts on inequality. The BIG idea is to universally provide an identical cash income floor that is essentially a UCT large enough to guarantee everyone a minimum level of financial resources on an individual basis entirely absent of imposed conditions — the basic income guarantee (BIG) or unconditional basic income.

This essay contributes to the discussion of inequality by identifying the possible forms and potential effects of the BIG on reducing inequality. Covering the two favored forms known as a negative income tax (NIT) and a universal basic income (UBI), I show that although both can function quite similarly on an economic level in reducing inequality, the UBI is the potentially stronger candidate on the political level due to its universality. I end this essay with a look at the numerous ways basic income could reduce both income and wealth inequality by reviewing the direct and indirect effects of a BIG on each.

An Island of Inequality

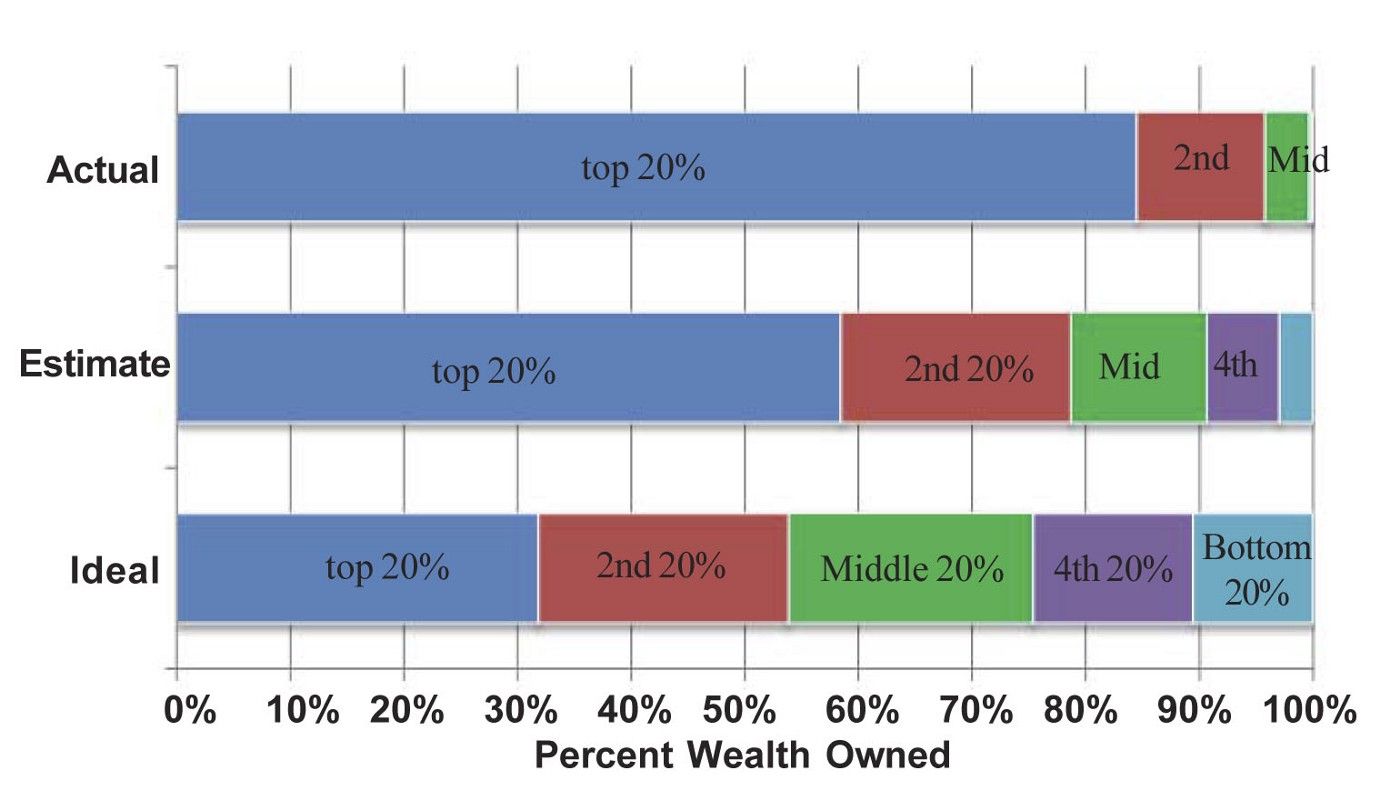

To understand how basic income could affect inequality, we first need to illustrate the current levels of both income and wealth inequality. To do this, we will imagine an island with a population of ten Americans, divided into fifths by income and wealth.

Using 2012 data, the income and wealth distribution on the island is as follows. The richest two Americans have 85% of the wealth and 52% of the income. The second richest two have 11% of the wealth and 20% of the income. The middle pair has 4% of the wealth and 15% of the income. The next two have 9% of the income and the poorest two have 4% of the income. The bottom four collectively have so little wealth, it is essentially zero.

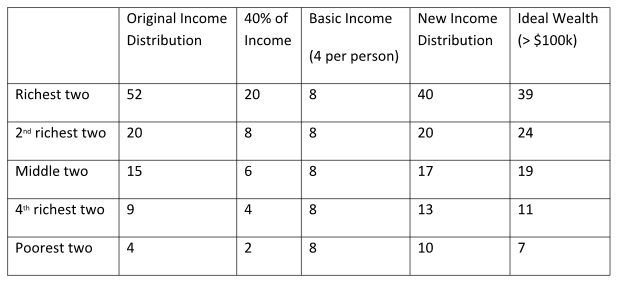

Now, let’s imagine these ten people together decide there is something wrong with how the distribution of wealth and income has worked out on this island. First focusing on income, they consider various plans so as to ensure each of them has at least the bare minimum income required to meet all of their basic needs, together concluding this minimum is 4 coins per person. Deciding it would be both the fairest and simplest plan of all for each of them to put the same percentage of their incomes into a pot, and then equally share the pot’s resultant contents with each other to obtain this minimum, the outcome is the following.

Deciding that 40% is fair knowing they will all pay the same percentage and get the same mutually defined minimum amount of coins back, the richest two put 20 coins into the pot. The next two put in 8 coins, followed by the middle two with 6 coins. The second poorest two together chip in 4 coins, and the poorest two add 1 each. The pot now holds 40 coins, so each person individually gets their 4 coins defined as a basic income back. The island now has a new income distribution of decreased income inequality.

The richest two now have 40 coins, which is still twice that of the next richest pair who ended up with the same number of 20 coins as they had before, for no net change. The middle two have 17 coins, experiencing a small net gain of one coin each. The second poorest two now have 13 coins, for a gain of two coins each, while the poorest now have 10 coins, for a net gain of three coins each.

One interesting observation to note about this particular income distribution, is to compare it to what those earning over six figures in the U.S. feel is the ideal distribution of wealth. We use this particular ideal knowing that wealth inequality is far more extreme than that of income, and that the ideal of those with the largest incomes shows the most extreme greatest ideal inequality of any income group. In other words, an ideal distribution of wealth as defined by those earning the most money and applied to distribution of income, reveals an upper limit to income inequality that can be defined as acceptable by all of society — a limit which we currently far exceed.

Adapted for this island example, preferred coin distribution is for the richest two to have 39 coins, the next two to have 24 coins, the middle two to have 19 coins, the fourth two to have 11 coins, and the poorest two to have 7 coins. The distribution of maximally acceptable inequality is actually very close to the island’s new distribution after basic income, and so this could be viewed as an ideal outcome.

Another note to make is that when asked about wealth redistribution, according to Norton and Ariely all groups agreed that such redistribution should take the form of moving wealth from the top quintile to the bottom three quintiles, without touching the second quintile. This is exactly what we see with this basic income example, and so we can safely assume that at least in theory, all quintiles could support the idea of basic income in practice as effectively redistributing income from the top to the bottom in the attempt to reach something closer to an ideal redistribution that even the richest view as ideal.

UBI vs. NIT

Now, one may look at this island example and think it wasteful for everyone to have put coins into a pot, only to pull them back out. Why couldn’t the richest two have just taken 12 of their coins and given 6 to the poorest two, 4 to the second poorest, and 2 to the middle? The outcome would be identical, and the 2nd richest pair need never even be involved in the process at all. Plus the total amount of coins changing hands could be merely 12 instead of 40. Why not just use this plan instead?

This is exactly what the debate between a NIT and a UBI boils down to. The example of everyone pooling their money together in the same pot is UBI (funded by a flat income tax), and the example of just getting the top to give more money directly to the bottom is a NIT (funded by increased income taxation on only the richest). The UBI can be seen as appealing to a sense of universal fairness and simplicity, while the NIT can be seen as just making sure the top quintile guarantees the bottom three quintiles have enough in a way that requires lower taxation than UBI. The former can be seen as potentially more efficient from an administrative perspective while the latter can be seen as potentially more efficient from a distributional perspective.

However, these two ideas diverge in how they are perceived not by economists, but by the public. A UBI includes all groups. Each group contributes to the pot and everyone gets the same amount from the pot in return. Being universal, a UBI increases social cohesion, in the sense that everyone is working together to make sure everyone benefits. A NIT lacks the potential to increase social cohesion to the same degree, instead putting the responsibility entirely on the rich to pay for the poorest. Although efficient, this could have unintended consequences, and could result in the rich using their riches to fight against such a policy. It might also leave the poor feeling the stigma attached to income received by only mostly them and no one else.

Whichever form of BIG is put into practice, be it UBI or NIT, its immediate effect of reducing income inequality should now be apparent. However, if we wish to fully evaluate the effects of basic income on inequality in a wider sense, we must take a closer look at each of the direct and indirect effects on both income and wealth inequality, according to the varying ways a basic income could be made possible. It is important to understand that the effects of a BIG can vary according to the way or combination of ways in which it is funded.

Direct effects of basic income on income inequality

The direct effects of basic income come in two flavors depending on whether it is the result of moving already existing money around to new hands, or by creating entirely new money.

Income redistribution

Funded through income taxation, basic income would function as a form of income redistribution, directly reducing extreme levels of inequality to levels considered more ideal. This could be achieved through either flat income taxation or increased progressive income taxation. Both methods would have the effect of redistributing income from the top 20% to the bottom 60%, with the least going to the middle and most to the bottom.

Expansionary monetary policy

Funding through money creation would also directly decrease income inequality but it would not be advised as the sole source of funding, as inflation would serve to impact the poor disproportionately, increasing costs of living and eroding the effective value of the basic income. For this reason a basic income should either be funded entirely or mostly by redistribution with only partial funding through any expansion of the money supply.

Indirect effects of basic income on income inequality

The indirect effects of basic income on inequality are less obvious but very much there. The most notable indirect effects are possible through two channels: large multiplier effects, and increased entrepreneurship.

Multiplier effects

A recent macroeconomic model showed the surprising results of food stamps not only having the greatest stimulus effects of all U.S. transfer programs, but also the greatest stabilizing effects of any current fiscal policy. The origin of the stimulus is in the redistribution to those with the highest propensity to consume — the poorest. This is known as the multiplier effect, and although food stamps have been found as showing the highest multiplier effect of U.S. programs of 1.79 (where the spending of $1 adds $1.79 to the economy), even higher levels have been observed in countries with basic income-like unconditional cash transfers. Some examples of UCT multipliers: Malawi (2.45), Lesotho (2.23), and Ethiopia (2.50). In contrast, the multiplier effect of Wall Street bonuses was calculated to be 0.39. Giving money to the rich slows the economy, while giving money to the poor grows it.

Entrepreneurship

One notable effect across all projects and pilot experiments of basic income is the increase in numbers of people starting their own businesses. GiveDirectly — a charity creating troves of valuable data by transforming the lives of the poorest in places like Kenya and Uganda through nothing but cash has referred to this on their blog with the observation that “there’s no charity for power saws.” In surveying the villages of those given basic incomes, they discovered that people were using their money as startup capital. One couple bought a solar panel to charge others’ cell phones. One person bought a power saw to employ himself as a tree trimmer and wood seller. Another person bought a motorbike to leave the farm behind and go into business for himself. Another person bought a tractor and was then able to create employment on her farm for others in the village. The examples go on.

What are the effects of all this enhanced entrepreneurship on future incomes? In Uganda a 49% increase in earnings was found over the first two years and a 41% increase remained another two years later. Meanwhile in Kenya, incomes were found to be 33% higher one year later. These are increases in earnings above and beyond the basic incomes only made possible by receiving them. This kind of result is not an anomaly, but a common finding where a basic income is given. People use the cash given to them to increase their labor market incomes. This effectively decreases income inequality even further than a basic income alone.

Direct effects of basic income on wealth inequality

Basic income can be funded in a variety of ways and so extends beyond taxing incomes to methods of directly taxing forms of wealth. Although not limited to these four, wealth-based basic income funding options include: land-value taxation, transaction taxes, natural resource royalties, and taxation of corporate stock.

Land-value taxation (LVT)

A tax on land values would serve as a means of transferring wealth from land-owners to non-land owners when used in combination with a basic income. Advocates of LVT have long seen it as a means of eliminating income taxes entirely, which could have the end result of being regressive in nature. If added as an additional tax to pay for basic income, LVT would serve to redistribute towards those who own no land, helping make it possible for more people to acquire their own land.

Natural resource royalties

Funding a basic income using natural resources is essentially the Alaska Model. By taking 25% of the revenue earned by charging oil companies for the rights to drill on Alaska-owned land, and depositing it in a large wealth fund, Alaska is able to annually distribute a dividend universally to all its residents. The size of this dividend in 2015 was $2,072 per resident. By charging companies rent for the use of public resources, this method can be seen as a way of making citizens partial owners of all natural resources, reducing the wealth of corporations without actually raising their taxes. Essentially this is a way of transferring money from corporations to the public as a cost of doing business instead of a tax.

Transaction taxes

A transaction tax could take the form of taxing all transactions as a tiny tax on everything. It could also just focus solely on the financial sector by taxing all trades in general, or more specifically tax only high-frequency trades. In any case, this form of tax would have the largest effect on those with the most money doing the most transactions, reducing wealth gains at the top. Paired with a basic income, this lessened wealth at the top would help grow wealth at the bottom.

Stock taxation

With most wealth at the top existing in the form of private investments, a tax on corporate stocks might possibly be the most direct taxation of wealth possible. Paired with a basic income, this would serve as a transfer of wealth from the richest (who own most of the stock) to the poorest (who own no stock), also enabling the poorest to actually obtain some of their own stock.

Indirect effects of basic income on wealth inequality

Aside from the potential direct ways of reducing wealth inequality through a basic income, there exist more long-term secondary effects which go on to reduce wealth inequality even further. These secondary effects of basic income on wealth arise in the same way basic income enhances entrepreneurship – it increases opportunity. It expands on the ability of people to take actions they could not otherwise take. These actions can lead to greater wealth through the newly granted opportunity to gain wealth that would not otherwise exist at the bottom of the socioeconomic ladder.

Increased education

Possibly the greatest long-term effect of basic income is the positive effect it has on education. One of the most impressive observations of such an effect was seen in Canada’s “MINCOME” experiment. In the 1970s, residents of Dauphin were guaranteed a minimum income regardless of work. Although striking in itself that teenagers chose to reduce their hours worked as a result — instead choosing to focus more on school in order to graduate — even more striking was that graduation rates met and then exceeded 100%. This was possible because those who had dropped out of high school actually returned to finish.

Aside from high school graduation rates, basic income also has the potential to increase access to higher education, making it more affordable to young students just reaching college age. In addition, workers presently in the labor market looking to return to school to retrain for a new career path would be better enabled to do so. Education is almost universally thought of as a means of increasing one’s wealth, and so more people choosing to pursue their education — all else being equal — would likely result in further reduced wealth inequality.

Enhanced citizenship

At present, it should be clear what happens when political power concentrates within a small group of only the wealthiest citizens. This inequality exists due to the undue influence of money on the political process, and it is this inequality that can be reduced through basic income. Although true that each citizen has one vote, vast amounts of cash serve as artificial votes and citizens tired of being effectively disenfranchised by wealthy special interests drop out of the process entirely as a result.

Basic income has the potential to reverse this through two routes. On the one hand it would enable citizens to outspend even the rich on a small donation level. Enough voters spending just $50 of their basic income in an election would be sufficient to outspend big money. This would be much more possible than it is now, where currently so many are living paycheck to paycheck. On the other hand, it would enable citizens to actually be citizens, spending more of their time becoming informed of issues and also volunteering their time as active participants of democracy.

It is this potential effect of basic income on citizenship that could possibly have the greatest effect of all in decreasing inequality across the board. By transferring political power concentrated at the top of the wealth and income spectrums back to the great majority of people from whence political power is supposed to arise, a basic income may not stop at the redistribution of money. It could extend to the redistribution of political power.

Conclusion

This essay introduced an island example as a simplified way of explaining the most direct effect a basic income guarantee would have on decreasing income inequality to a point considered more ideal by even those desiring the greatest amounts of inequality. Continuing with the island example as a way of explaining the difference between unconditional basic income and a negative income tax, this essay left the choice open to further debate. However, I do lean toward a UBI as possibly having greater potential for political advocacy and long-term stability despite its perceived greater cost, due to its universality.

Finally, breaking inequality down into income and wealth differences separately, this essay showed how a BIG could reduce each through both direct and indirect effects. By functioning as a means of direct redistribution, a BIG would directly reduce inequality by transferring income from the top to the bottom, and this transfer could take place by means of income or wealth depending on funding choices. Meanwhile the indirect longer-term effects a BIG would have on the economy through enabling increased entrepreneurship and large multiplier effects, and the effects a BIG has on the choices of the people receiving it to pursue their educations or participate in democracy, all lead to even greater reductions of inequality than might be immediately apparent.

My thanks to Chris Oestereich and the rest of the WPC for putting this book together and special thanks to Arjun Banker, Steven Grimm, Larry Cohen, Topher Hunt, Aaron Marcus-Kubitza, Andrew Stern, Keith Davis, Albert Wenger, Richard Just, Chris Smothers, Mark Witham, David Ihnen, Danielle Texeira, Katie Doemland, Paul Wicks, Jan Smole, Joe Esposito, Jack Wagner, Joe Ballou, Stuart Matthews, Natalie Foster, Chris McCoy, Michael Honey, Gary Aranovich, Kai Wong, John David Hodge, Louise Whitmore, Dan O’Sullivan, Harish Venkatesan, Michiel Dral, Gerald Huff, Susanne Berg, Cameron Ottens, Kian Alavi, Gray Scott, Kirk Israel, Robert Solovay, Jeff Schulman, Andrew Henderson, Robert F. Greene, Martin Jordo, Victor Lau, Shane Gordon, Paolo Narciso, Johan Grahn, Tony DeStefano, Erhan Altay, Bryan Herdliska, Stephane Boisvert, Dave Shelton, Rise & Shine PAC, Luke Sampson, Lee Irving, Kris Roadruck, Amy Shaffer, Thomas Welsh, Olli Niinimäki, Casey Young, Elizabeth Balcar, Masud Shah, all my other funders for their support, and my amazing partner, Katie Smith.

Would you like to see your name here too?

Did you enjoy reading this? Please click the subscribe button and also consider making a monthly pledge in support of my daily advocacy of basic income for all.

_large.jpg)

UBI Guide Newsletter

Join the newsletter to receive the latest updates in your inbox.