There is No Policy Proposal by Any 2020 Presidential Candidate More Progressive than Andrew Yang’s Freedom Dividend

Primary season has begun and as Trump marches toward a possible second term, a list of Democrats over 20-candidates-long is vying for the honor of being the one who prevents that from happening. One of those candidates, Andrew Yang, has proposed a universal basic income of $1,000 per month that he calls a “Freedom Dividend.” As a longtime advocate of UBI, I have something to say about this, and the details of his plan as proposed.

This article is meant to be a detailed response to anyone claiming Yang “doesn’t care about the poor,” or that “a VAT makes the UBI regressive,” or that Yang’s plan “increases inequality” and is a “neoliberal Trojan horse meant to destroy the safety net.” None of those claims reflect reality. The reality is that while Yang’s proposal can certainly be improved, if signed into law as proposed, the Freedom Dividend would be the single most progressive policy advance ever signed into law in American history. To understand why this is true, we need to dive into the details, so here we go…

What is the Freedom Dividend?

The Freedom Dividend as proposed is an unconditional cash transfer of $1,000 per month that would go to every American citizen age 18 and up. The dividend is unconditional in that it carries no requirements, including any of the typical work requirements imposed on standard benefits. Unemployed? You get it. Do you have to prove you’re looking for a job? No. Do you have to attend any classes? No. Employed? You get it in addition to your paycheck. Can you spend it on anything? Yes. It’s cash. You are free to use it in any way you want, to buy anything you want.

Sounds simple, right? Well, there are some asterisks involved that people tend to miss, or misunderstand, and these can spread either accidentally with no ill intent, or maliciously with the full intent of eroding support through the spreading of disinformation. The most common inaccuracies being spread tend to revolve around the funding and the opt-out structure being proposed which offers people the choice of keeping their welfare benefits or receiving $1,000 per month in basic income, whichever is preferred.

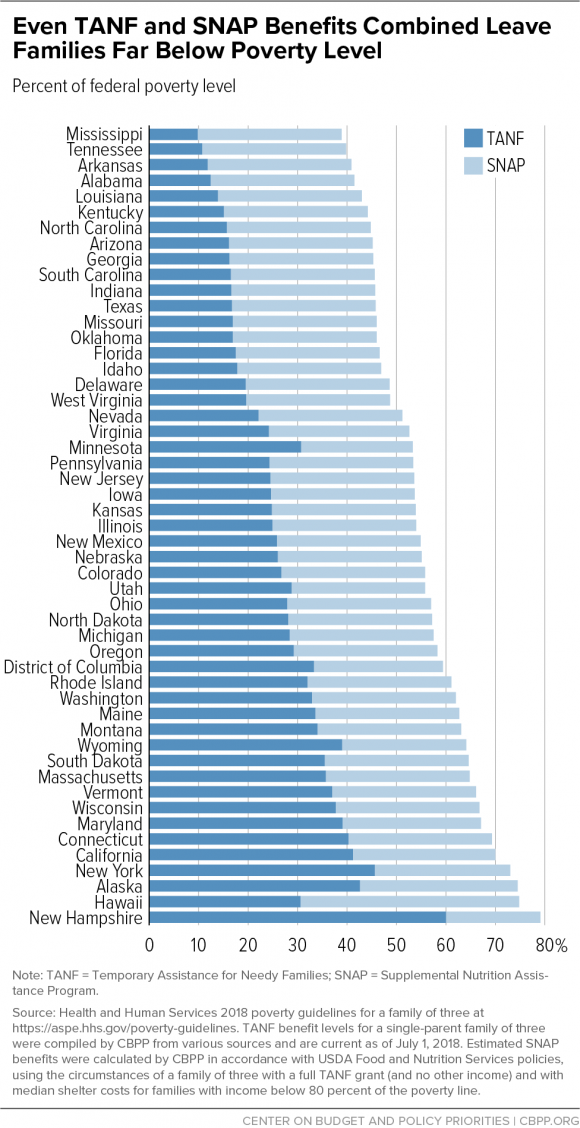

Here’s a partial list of programs that people would voluntarily opt out of in order to receive the Freedom Dividend: Temporary Assistance for Needy Families (TANF), Supplemental Nutrition Assitance (SNAP), Women, Infants, and Children (WIC), Supplemental Security Income (SSI). These programs provide less than $1,000 per month on average, even when combined.

Here’s a partial list of programs that would exist on top of the Freedom Dividend that no one would have to opt out of: Old-Age, Survivors, and Disability Insurance (OASDI) — aka Social Security and SSDI — unemployment insurance (UI), housing assistance, VA disability. These programs provide more than $1,000 per month on average.

For those concerned about health care, that’s a separate issue. People on Medicaid would only lose it if and when replaced by Medicare for All which is one of Yang’s two other core policy proposals alongside the Freedom Dividend and Human-Centered Capitalism.

As a rule of thumb, programs that are considered entitlements because they are contribution-based, will be earned as additional income to the Freedom Dividend. Programs that are considered welfare because they are based on low income, will mostly be offered as an alternative to the Freedom Dividend.

As one example, Anna is a single mother receiving $336 in TANF (median for household of two) and $247 in SNAP (average for household of two) for a total of $583 per month. Opting for $1,000 per month instead, she would effectively get an additional $417 per month, a 72% raise in income, unconditionally, and the conditions for her original $583 would be removed.

Question: So why provide people a choice between existing programs and the Freedom Dividend? Why not let them keep everything?

Answer: To maximize unconditionality.

Consider another recipient of existing benefits. Let’s call him Tom, and he receives $750/mo in TANF and SNAP combined. Tom is offered a job that pays $2,000/mo. Accepting this job will mean losing his $750/mo. His net income increase would thus be $1,250. That’s an increase of 167%.

Now, let’s say Tom opts for the Freedom Dividend instead of TANF and SNAP, and gets the same job offer. Instead of $750/mo, he has $1,000/mo as a starting point that doesn’t disappear with any amount of earned income. Going from $1,000/mo to $3,000/mo is an increase of $2,000, or 200%.

Finally, let’s say Tom gets to keep his TANF and SNAP on top of his Freedom Dividend and is offered the same job. In this case, in accepting the job, he would go from $1,750 to $3,000, which is an increase of $1,250, or 71%.

Between these three scenarios, there are three key takeaways. First, the scenario where the Freedom Dividend is instead of TANF and SNAP results in the greatest incentive to work. Employment makes Tom in that scenario three times better off, financially speaking. Second, the scenario with the worst incentive to work is the scenario where Tom keeps TANF and SNAP in addition to the Freedom Dividend. Tom actually has a better incentive to work in the scenario that exists today, than he would with everything stacking, because his relative increase with everything stacking would be smallest. Third, in the everything stacking scenario, in absolute terms, Tom is no better off than in the pure Freedom Dividend scenario and is objectively worse off. He still ends up with $3,000/mo, but he has to do a lot of paperwork and dehumanizing bureaucratic hoop-jumping along the way to maintain conditions compliance.

To emphasize this point, because it needs emphasizing, those who believe the entire existing welfare state should exist on top of the Freedom Dividend are demanding that we make everyone’s incentive to work even worse than the existing system already does. Because people would be lifted higher with the dividend, but then dropped the same distance upon losing their benefits as they are now, there’s even less reason to accept any form of employment. Instead of eliminating the welfare trap, it would be made into an even bigger trap. Fewer people would earn additional income, which would only serve to reduce instead of increase economic mobility.

I would argue that increased economic mobility is a progressive goal to achieve, and thus as proposed by Yang, the Freedom Dividend meets this goal better than stacking welfare on top of the Freedom Dividend. Besides enhanced mobility, another reason for welfare benefits not to stack is because of all the restrictions imposed, and the damaging effects of those restrictions.

TANF is a prime example of a welfare program that is functionally regressive. Designed as a federal block grant provided to states to use essentially as they please, states have been using less and less of it on cash assistance to low-income people. It now pays non-profits to teach pregnant women to get married, helps fund the college educations of middle and upper-middle income kids, and is actively responsible for 15% of the black-white child-poverty gap in America.

How is it that conditional welfare programs like TANF are actively increasing the racial divide? In the book Disciplining the Poor, it’s described as “neoliberal paternalism.” Because a dollar in welfare has about three to five times as many strings for someone who is black than someone who is white, the severity of the conditions themselves, and the punishments applied for not meeting those conditions, can actually function to leave people (disproportionately people of color) worse off than if they’d never applied for assistance in the first place. Not only that, but people exposed to the worst conditions and punishments learn lessons that hurt democracy. They retreat from participating in politics. They become less likely to make their voices heard, and less likely to participate in elections and community organizations.

Too many assumptions are made about conditional welfare, and these assumptions tend to be made by those who have never experienced the process of getting, using, and keeping them, and these assumptions tend to be based on whether one is liberal or conservative. If liberal, these programs are godsends that save the lives of everyone in need. If conservative, these programs are demonspawn that rob hardworking Peter to pay lazy pill-popping Paul. Nuance, lived experience, and data are missing from these assumptions. Here’s the reality beyond the racial elements already covered.

Thirteen million Americans living in poverty are entirely disconnected from the federal safety net. They receive no assistance at all. A third of those in severe poverty defined as half the poverty line, get nothing. By any conceivable measure of need, these are the neediest Americans, and conditional benefits don’t reach them. Why they don’t is a combination of not knowing the help is possible, not wanting the help because of the stigma, not properly applying, not qualifying despite living in poverty, and being kicked off. When it comes to TANF cases, 20% are closed due to non-compliance, 15% are ended because of sanctions, and 13% of people just quit. Only 16% get off TANF because of employment, and only 1.3% reach the time limit. About two out of five people who qualify for SNAP never even apply, and to qualify for SNAP or SSI one must have less than $2,000 in assets and keep it that way.

Did you know that in some states, you must prove you’re homeless by providing a document you can only get from an approved homeless shelter verifying you’re homeless?

Did you know that over 10,000 people die every year while waiting with over one million other Americans to prove they’re sufficiently disabled enough to receive disability benefits? The average wait time is now two years, and there is a minimum wait time of five months.

Did you know that people receiving $5 per day in SNAP benefits can be forced to spend eight hours a day in a “work-search office” where if they are five minutes late they can lose their benefits? That works out to 63 cents per hour, even less if one considers the cost of getting to and from the office.

Did you know WIC can only allow mothers to purchase cow’s milk that is fat-free or low-fat, cheese that is domestic only, and eggs that are white and smaller than large? That’s the level of control these programs have over everyday decisions that non-recipients take for granted.

According to Kate Miechkowski, a social worker who has begun asking her clients if they’d prefer to keep their conditional welfare assistance or receive an unconditional $1,000 per month instead, out of 38 asked so far, only 2 have said they’d prefer to keep their conditional benefits. One even replied that the Department of Social Services (DSS) makes them “want to blow their head off,” because of how they’re made to feel like a “shitty person.” Another said they’d work three jobs if they could, to not have to deal with it.

Why do some progressives want to continue subjecting people to such dehumanizing and humiliating treatment? Because unless people get an extra 15% per month in SNAP that prevents them from having more than $2,000 in assets, and that requires doing pretend-work eight hours a day for the luxury of the extra $5 a day they can’t even spend on hot food or diapers or hygiene products, that they’ll be worse off?

Progressives need to accept that conditional programs aren’t progressive. They are paternalistically neoliberal. The most progressive thing to do is to lift everyone up without conditions, and to remove the conditions of the cash and cash-like welfare benefits already being received. If what they’re currently receiving is more than $1,000 per month, then let them keep those benefits if they choose, but let them also opt to escape them if they choose.

Conditions exist as they do for a reason. Although popular belief is that the conditions exist to make sure to target the deserving and exclude the undeserving, the real purpose of these conditions is punishment. The more punitive the programs, the fewer people will be on them. The goal is to discipline people into escaping poverty, to teach them that becoming poor was a mistake, especially if they are people of color. And as long as they are given any help, they need to be manipulated and restricted into making the right decisions, because if they could make the right decisions on their own, they wouldn’t be poor in the first place, right?

No. That entire line of thinking is regressive.

Okay. Not stacking conditionality onto UBI is progressive, but what about how Yang plans to fund his UBI with a 10% value-added tax (VAT)? Isn’t that a regressive tax that would make UBI’s tax burden fall disproportionately on the poor?

The 10% VAT

It is indeed true that a VAT is a regressive tax. Because it is a tax on consumption, and those with low incomes spend a larger percentage of their incomes on consumption goods than those with high incomes, those with low incomes are disproportionately impacted. However, in the case of a UBI-VAT, the revenue is fully rebated, and in such a way that those with low incomes receive far more than they pay, and the rich pay far more than they receive.

Think of it this way. Let’s say you wanted to provide $90 to a homeless person, free and clear. One way of doing that is to hand over $90. Another way is to hand over $100, and ask for $10 back. Both result in them having $90 more. It’s nonsense to claim that the second example is regressive because the homeless person loses $10. The net outcome is a $90 gain.

Furthermore, the $90 is coming from corporations like Amazon, reducing their profits, and also the spending of the rich, reducing their total disposable incomes. Amazon is able to avoid federal income taxes (they paid $0 on $11.2 billion in profits in 2018), but they can’t avoid a VAT because it is applied to every step of production, which is why it’s a tax used in more than 140 countries worldwide, including progressive champions: Finland, Norway, Sweden, and Denmark. Businesses like Amazon primarily have two choices with VAT. They can avoid price increases by reducing their profits, or they can pass on price increases to consumers. If they reduce their profits, that effectively increases the buying power of consumers. If they pass on the VAT to consumers, because of the $1,000 per month UBI, and assuming all 10% is passed on, consumers would need to be spending $10,000 per month to not see a net increase to their incomes. A net decrease is physically impossible for anyone earning less than $120,000 per year.

One caveat is that for those who choose to keep their existing benefits, their spending power could be reduced by the VAT by up to 10%, and in response to this, Yang has suggested boosting their benefits to compensate for this loss of buying power.

A distributional analysis done by the UBI Center concluded that given the details of Yang’s plan, 86% would come out ahead. Looking at only those earning under $25,000 per year, 90% would come out ahead (those that don’t come out ahead are mostly non-citizens). The bottom 10% would see their disposable incomes increased by almost 120% while the top 10% would see their disposable incomes reduced by 4%.

This is a highly progressive outcome that also provides stability for all.

Furthermore, when it comes to reducing poverty, 74% fewer households would have disposable incomes that fall under the federal poverty line. That’s a huge reduction in poverty. The only program that comes close to that level of poverty reduction is Social Security, which reduces poverty among seniors by 75%, except instead of only impacting seniors, the Freedom Dividend would impact everyone. It would virtually eliminate poverty among seniors and also further reduce poverty among those with disabilities because of stacking with OASDI (Old Age, Survivors and Disability Insurance). In fact, because everyone receiving Social Security and SSDI would receive an additional $1,000 per month, it could be seen as the largest expansion of Social Security since its creation, and because everyone would get it, it would essentially be Social Security for All.

When it comes to reducing inequality, America’s Gini index score would fall by 15%. We would be 15% more equal than we are now. No other policy being offered by any other candidate achieves that level of inequality reversal.

The Rub of Conditions

One of the main reasons inequality is reduced so much by UBI is because of how many people in poverty are excluded from the existing safety net. Right now, 76% of people who qualify for housing assistance don’t get it. There are 65 million adults in the US living with some form of disability, and only 14 million of them receive SSI or SSDI. That’s 23%. The remaining 77% are left to compete with the fully abled in the labor market where they experience poverty at over twice the national average.

When it comes to cash welfare, in Texas, only 4 out of 100 families living in poverty receive TANF. 18 states out of 50 provide cash to the poor that’s less than $200 per month, and 16 states entirely exclude more than 90% of those living under the poverty line from cash assistance. The Freedom Dividend would change those numbers to 50 out of 50 states providing $1,000 per month, and 50 states excluding 0% of citizens living in poverty. That’s why inequality would be reduced so much by UBI, because conditionality ends up excluding far too many people.

Additionally, do you think it would be fair if conditional benefits were stacked on top of the Freedom Dividend, so that for every 100 impoverished families, 23 were lifted above the other 77 equally impoverished families? Is it progressive to provide more to some than others, despite them both being equally poor?

The conditions that exclude so many people in need from assistance are also the same conditions that kick people off assistance. As the system exists today, if everyone won a lottery that paid out $1,000 per month for life, virtually everyone would immediately lose their welfare benefits, because most everyone would be earning enough money to no longer qualify. The entire point of these programs is to only benefit the “deserving poor,” so why is it so important to stack TANF, SNAP, WIC, and SSI on top of UBI, if by existing definition, someone earning $1,000 per month is not considered deserving?

The same result would occur if everyone got a job earning $1,000 per month. Does that mean employment is a Trojan horse designed to destroy the safety net, because if everyone had a $1,000 per month job, there would be far fewer people on benefits? Does that mean a job guarantee is in fact the ultimate Trojan horse, because it intends to disqualify as many people as possible by paying everyone $30,000 per year to do the guaranteed jobs? Hyman Minsky certainly saw it that way when he said, “The guarantee of an income through a job is the first step toward the elimination of the welfare mess.”

All of these welfare programs are also temporary. TANF lasts for a maximum of five years. Assuming someone is fortunate enough to receive $1,000 per month in TANF, and they receive the payment for the full five years, and they live for another fifty years, the Freedom Dividend is ten times larger because of its unlimited lifespan. Is it progressive to prevent someone in poverty from gaining $660,000 in order to prevent them from losing $60,000?

Lifelong income from age 18 to death is far more progressive than any temporary program, especially when 1 out of 5 welfare recipients stops receiving their benefits within 7 months, and the average total benefit is less than $833 per month. Making sure someone in poverty receives $5,831 in exchange for 7 months of 20 hours a week of job searching will never be as progressive as making sure someone in poverty is lifted out of poverty, without conditions, for as long as they live.

A permanent unconditional income also means never being made worse off by a raise, or a gift, or some inheritance. Because the Freedom Dividend is never lost, there’s no possible situation where additional income would leave someone worse off. If conditional benefits were stacked on top of the Freedom Dividend though, that would no longer be true. Earning $15 per hour instead of $13 per hour could mean a loss in benefits larger than the raise.

Unconditional basic income is also the only way of finally remunerating the 1.2 billion hours of unpaid work going on every week, and enabling even more of it. For anyone who supports a living wage in the belief that no one working full time should live in poverty, this belief should be extended to include all forms of work. Paid work is not the only way of contributing to society. With UBI, we can for the first time liberate our most meaningful work from employment. And by creating the option to choose unpaid work and even more leisure over paid work, we also grant the power to demand that paid work actually pay.

Conclusion

I believe that nothing is less progressive than the perpetuation of an inhumane and undignified system built on a foundation of distrust, control, and humiliation. It is a conservative ideology to wish to maintain the status quo, to avoid change, to protect what exists for the sake of stability in fear that change could lead to worse results. Progressives on the other hand, are concerned about making changes that make things better, but “better” is inherently subjective. This is why progressives have a hard time agreeing on what steps to take despite fully agreeing that steps need to be taken.

Some progressives are scared that one step forward could lead to two steps back, and thus support no steps forward. Other progressives believe that unless five steps forward are taken, no steps forward should be taken. Some progressives have less interest in measurable progress than they do an ideal where a romantic notion of revolution is of greater seduction, however violent and full of suffering, than peaceful evolution. These progressives are willing to burn it all down in the hope something better will emerge.

I however believe that progressivism is about pragmatic progression. A step forward is a step forward, and we should always be stepping forward. After every advance, there’s always another advance to make, and we should not refuse to make those advances or misrepresent them because “they aren’t big enough.” We should care about measurable improvements, and we should do so with unceasing empathy. If a program makes people miserable, is that a program to defend? Or is it a program to move beyond?

If unconditional cash has been shown to lead to improved physical and mental health, reduced crime and intimate partner violence, improved educational outcomes, more entrepreneurship, increased social cohesion, increased trust, greater life satisfaction, enhanced resiliency to disasters, fewer deaths of despair, and numerous other positive effects with no negative impact on work, why would we not evolve our system to what obviously works better?

Is the goal of the progressive movement revolution or evolution? Your answer to that question as a progressive may very well decide whether you support Andrew Yang or not. The Freedom Dividend is the evolution of our safety net into a solid foundation, one that should rise with the rise of automation, so that technology always benefits everyone as MLK himself suggested when he wrote, “the guaranteed income must be dynamic; it must automatically increase as the total social income grows.” If you believe what Yang is proposing we start at isn’t enough, then fight for what you believe would be better, and demand that all candidates fight for your ideal UBI. And if those candidates refuse to consider your UBI, you need to ask yourself a question…

Is it progressive to not support the greatest reduction of poverty and inequality — and greatest increase in freedom and dignity — ever proposed in American history, because you insist upon preserving paternalistically neoliberal conditionality?

Special thanks to: The Gerald Huff Fund for Humanity, Haroon Mokhtarzada, Steven Grimm, Andrew Stern, Roy Bahat, Floyd Marinescu, Zack Sargent, Larry Cohen, Aaron T. Schultz, Tom Cooper, Robert Collins, Stephane Boisvert, Justin Walsh, Daragh Ward, Joanna Zarach, Ace Bailey, Albert Wenger, Victor Lau, Athena Washington, UBIVisuals , Garry Turner, Peter T. Knight, Danielle and Michael Texeira, Jack Canty, Paul Godsmark, Rachel Perkins, Chris Rauchle, David Ihnen, Michael Hrenka, Natalie Foster, Reid Rusonik, Daniel Brockman, Carrie Mclachlan, Michael Honey, George Scialabba, Che Wagner, Jess Allen, Gerald Huff, Will Ware, Jan Smole, Joe Ballou, Gray Scott, Myi Baril, Elizabeth Corker, Max Henrion, Arjun Banker, Chris Heinz, Chris Smothers, Janos Abel, Kai Wong, Phuong Truong, Jill Weiss, MARK4UBI , Elizabeth Balcar, Georg Baumann, Jessica Wales, Kirk Israel, Valentina Petricciuolo, Meshack Vee, Timothy P O’Connor, Kev Roberts, Chris Boraski, AYFAQ.com , Stephen Starkey, VilliHaukka , Michael Finney, Casey L Young, Brian Schwartz, Tim , Oliver Bestwalter, Thomas Welsh, Walter Schaerer, Michael Finney, Sanford Redlich, all my other funders for their support, and my amazing partner, Katie Smith.

Would you like to see your name here too?

Did you enjoy reading this? Please click the subscribe button and also consider making a monthly pledge in support of my daily advocacy of basic income for all.

_large.jpg)

UBI Guide Newsletter

Join the newsletter to receive the latest updates in your inbox.