This Idea Can Literally Change the World: Universal Basic Income Through Carbon Pricing

A Bipartisan Free Market Solution to Climate Change Through Atmospheric Justice

September 2, 2021 update: It’s been almost four years now since I originally wrote this article. Currently a huge reconciliation bill is working its way through Congress with a portion of the bill meant to address climate change. There is a chance that carbon pricing could make it into this bill, especially because it’s a revenue-neutral option. If you want to help make this happen, please be sure to contact your representatives in the House and Senate and tell them that you want carbon pricing with a cash back rebate to be part of the reconciliation bill.

February 20, 2019 update: It has been just one year since I originally wrote this article, and in that time over 3,300 economists have now signed onto a statement in support of carbon dividends, recommending that the most cost-effective way to reduce carbon emissions at the scale and speed necessary to act sufficiently on climate change is to implement an annually rising carbon tax where the revenue is returned directly to U.S. citizens through equal lump-sum rebates. This policy recommendation is thus officially now the largest public declaration in the history of economics. The Energy Innovation and Carbon Dividends Act also now exists in both the U.S. House and Senate, and Canada has in 2019 become the first country in the world to implement carbon dividends nationwide.

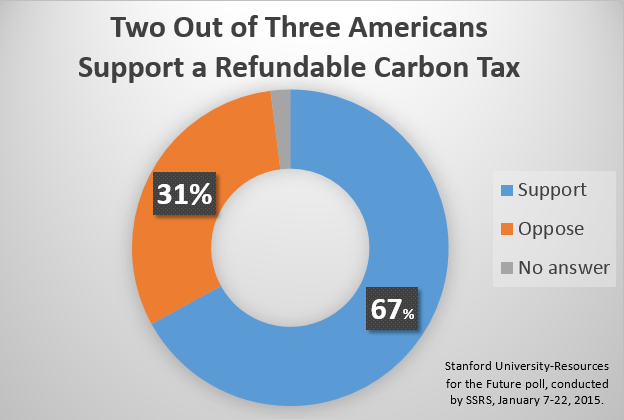

There’s an idea out there with a large and growing consensus of support. Experts long focused on climate change like James Hansen and Bill McKibben see it as an absolute no-brainer of a policy at this point, which is why about 90 countries included some version of it in their plans as part of the Paris Climate Agreement. Despite its absence so far in the Republican platform and its only just recently being added to the Democratic platform, a survey done by Stanford in 2015 found that 67% of adults in the US approved of the idea as long as it was revenue-neutral. This means the revenue raised by it would not be spent by government. Instead, all revenue would be refunded to everyone equally, which it can and arguably should be, so as to transform it from regressive to progressive, and to gain necessary support from both ends of the political spectrum.

So what’s the idea?

Revenue-Neutral Carbon Taxation

At its most simple, the idea is to make it cost more for everyone to use the atmosphere as a toilet. In its most ideal form, the idea is to add a new and annually increasing fee per ton of CO2 equivalent greenhouse gas emissions, and to simply rebate that revenue back to everyone in the form of monthly dividends for all.

The idea is called a revenue-neutral carbon tax, or carbon tax and rebate, or carbon fee and dividend, or carbon fee and rebate. Pick your favorite.

Changing Behaviors

Some hear this and think, what’s the point of taking more money from people and then giving it straight back to them? Well, the point is to nudge behavior. If gas costs $4 per gallon instead of $2 per gallon, we’re going to drive less. If airline tickets cost more, we’re going to fly less. If it costs more to pollute, we’re going to pollute less. Whatever we tax, we tend to reduce it. That’s also one of the reasons more than a few economists don’t like income taxes, while others love the idea of a land value tax.

Creating Choices

The creation of monthly cash dividends with carbon tax revenue then additionally enables new market choices. For example, let’s say gas costs $2 without a carbon fee and rebate, but $3 with a carbon fee and $1 rebate. Do we wish to drive around just as much with $3 gas thanks to being able to afford that choice with the extra $1, just as much as we did with $2 gas and no dividend, or do we wish to drive less and use the $1 dividend elsewhere? Perhaps we’d instead prefer to use that money on a new electric car or solar panels? Perhaps we’d prefer to use it on education or training, or more nights out with friends and family, or to pay down debts or build savings? Or to start a new business? The rebate creates new options for consumers that weren’t there before the fee was applied.

Green Competitors

Creating new options is the real power of carbon fee and rebate. It flips the script on the carbon economy and makes the green economy far more competitive. If energy from coal and oil is cheaper than energy from solar and wind, but then we tax coal and oil to make it just as expensive or even more expensive then their green competitors, more people will choose to opt instead for solar and wind. New green businesses will form, creating new green jobs to meet greater green demand from more customers with more money making greener choices. Carbon dividends offer a market solution for climate change.

Price Externalities

In fact, it’s not only about making fossil fuels and greenhouse gases cost more. It’s about recognizing that their relative cheapness is because their true cost is not being paid for because of cost externalization. Estimates have put this cost at $41-$124 per ton, meaning that adding at least a $40 per ton fee is not only a smart idea to fight climate change, and returning the revenue to everyone is not only a smart idea to increase incomes and market choices, but it corrects inefficient market outcomes. In economic terms, it’s called a “Pigovian tax.” Instead of distorting markets, it corrects market failures.

Think of it this way. If you and I were neighbors and I polluted the air with noxious gases on a daily basis such that you developed health problems, who should pay your bill? You or me? Right now, you are the one being told to pay the bill because you’re the one that got sick. This is what’s happening with increased cancer rates. A carbon fee and rebate says that it should cost me money to use the atmosphere as my personal gas toilet because I’m the one who made you sick, and you should be the one that money goes to because you co-own the air. It’s your right.

Progressive Not Regressive

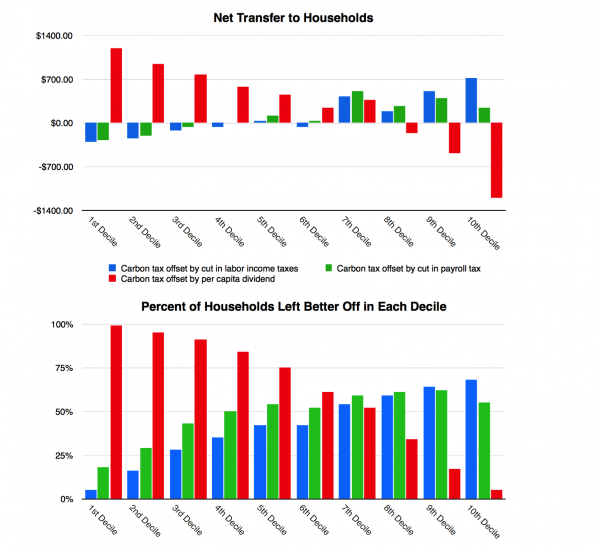

It’s true that a carbon tax alone is regressive. Carbon taxes disproportionately impact those with the least money, because spending an extra $50 each month is a much bigger deal to someone who only earns $1,000 each month than someone who earns $1 million each month.

However, for the same reason, receiving $100 extra each month is also a much bigger deal to those earning $1,000 than $1 million. What it comes down to is who has the larger carbon footprint, and the answer is those with the most money. Estimates show that on average, those in the top 30% of earners will pay more due to the carbon tax than they receive in the flat rebate, and the bottom 70% will receive more in the flat rebate than they pay in higher costs. That’s a highly progressive outcome that is not achieved by just reducing other taxes.

Basic Income 101

Additionally, the best thing in my opinion about a carbon fee and rebate approach to fighting climate change is that it also happens to be a big and immediate step toward unconditional basic income (UBI). Using a model provided by the Carbon Tax Center, if we applied a $40 per ton fee to CO2 tomorrow, and increased it by another $15 every year, in just three years every US citizen would be receiving around $100 per month. That’s about 10% of the way to a basic income, and thus the cost of implementing a basic income would be nicely reduced. In another 9 years, every US citizen would be receiving $200 per month. By 2040, it would be $300 per month.

Meanwhile, people would quickly become accustomed to receiving a monthly dividend check in their mailbox or bank account independent of and in addition to any other income, and we’d also learn how that money tends to get spent right back into the economy to stimulate it and create new jobs.

Even better, we’d also surpass our goal of reducing our emissions by 28% below 2005 levels by 2026, by reducing them instead by a whopping 50%!

Global Evidence

Iran actually managed to accomplish something very close to both a carbon tax and a universal basic income by eliminating their oil subsidies that made fossil fuels super cheap, and instead giving 96% of their citizens cash to afford the newly unsubsidized prices. One of the reasons they did this was that they found cheap gas led to the richest wasting a lot of gas, and therefore all the money they were putting into subsidizing oil to help the poor was actually disproportionately helping the rich. By replacing the subsidies with cash, they instead began disproportionately helping those with lower incomes as originally intended. The story in Iran is a bit more complicated than this though, and still ongoing, so I recommend reading From Price Subsidies to Basic Income: The Iran Model and Its Lessons, and Cash Transfers and Labor Supply: Evidence from a Large Scale Progam in Iran to learn more.

Canada as usual is ahead of the curve with a revenue neutral carbon tax already in place in British Columbia since 2008 and with national policy planned to begin in 2018. However, the BC carbon tax is not a true dividend model, instead mostly lowering individual and business taxes and for the poorest providing a tax credit. However, even if not optimally designed IMO, it is still a success. It has dropped fuel consumption, decreased greenhouse gases, and has even slightly increased economic growth compared to the rest of Canada. In short, it’s already been tested, and we already know it works.

Resilience

As a resident of New Orleans, I also look at this from a resilience perspective. Climate change causes climate disasters. It means more houses burning to the ground while other houses end up underwater due to unprecedented flooding. When disaster strikes, people through no fault of their own are forced to evacuate their homes and live in hotels far away. They then return home to begin the entire rebuilding process, possibly without a job, and possible waiting months before any insurance payouts or government grants/loans arrive, that is if they’re not unlucky enough to get nothing at all.

A monthly carbon dividend of $200 may not sound like much to you, but when you’re in the position of having just lost everything you own, it makes all the difference in the world. That’s why Dolly Parton provided people with $1,000 per month who lost their homes to wildfires in Tennessee, and why GiveDirectly showed up in Texas to give out $1500 debit cards. Money may not be the only thing we need after disaster strikes, but it’s pretty much something we always need when disaster strikes.

Not convinced yet? Maybe this guy’s support and reasoning will help…Our favorite billionaire Martian

All we are doing [with a carbon tax] is trying to match the inherent subsidy for fossil fuels . . . on the sustainable energy side. Fossil fuels are already getting a massive subsidy… The real right way to correct [the subsidy] would be to establish a carbon tax. If you ask any economist they will tell you that is the obvious thing to do, put the correct price on carbon because we currently have an error in the economy which misprices carbon at zero or something closer to zero. It is a fundamental economic error. — Elon Musk

Not Left or Right

There are many more than Elon Musk who support putting a price on carbon, and from all over the world, including conservatives. Believe it or not, even the former CEO of ExxonMobil and now Secretary of State Rex Tillerson supports a revenue neutral carbon tax, and ExxonMobil is now lobbying for it.

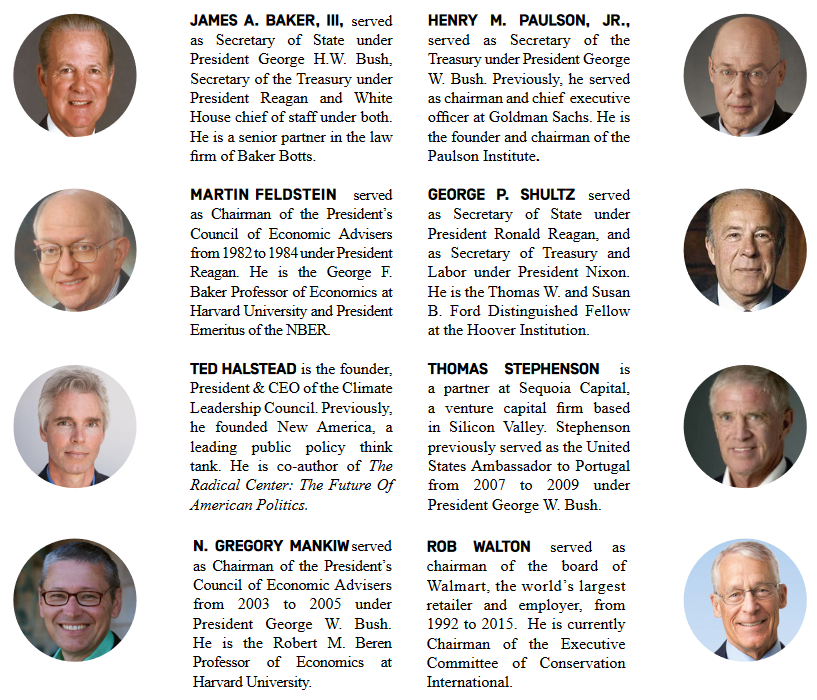

An organization called the Climate Leadership Council in 2017 even published “The Conservative Case for Carbon Dividends.” Its authors were James Baker, Henry Paulson, Martin Feldstein, George Shultz, Ted Halstead, Thomas Stephenson, Greg Mankiw, and Rob Walton. Ted Halstead even went on soon after to deliver a TED talk about it, which you can watch below.

And, even more recently, a bipartisan coalition of 34 student groups in the US (including 23 College Republican groups, 6 College Democrat groups, and 5 environmental groups) announced the formation of Students for Carbon Dividends, endorsing the above CLC plan.

Basically a carbon fee and dividend policy is a good idea for the same reason unconditional basic income is a good idea. It’s an idea both the left and the right can get behind. It’s market friendly and even market correcting, while also reducing poverty, inequality, and climate change all at the same time. For the good of the entire planet, there is perhaps no policy (other than UBI itself) that makes more sense in immediately adopting everywhere possible — as soon as possible — than this policy. I also believe there is no policy with the intent of functioning as a foot-in-the-door for full UBI that is more superior than fully universal carbon dividends.

Partial vs. Targeted

For supporters of UBI, there are mainly two roads to achieving full UBI which even if passed tomorrow would likely be phased in over a matter of years. One is to begin by paying a full amount to part of the population and then growing it in time to cover the rest of the population, and the other is to provide a partial UBI to the entire population and then growing it in time to a full UBI. Two notable recent examples of the former are the RSA’s proposal for a universal basic opportunity fund or UBOF, and Chris Hughes’ proposal for guaranteed income or GI. The UBOF would only be available two years out of ten, and only for those between 18 and 55 (hypothetically). And GI would be $500 per month for everyone working but earning less than $50,000 per year (hypothetically). Both are steps forward, but targeted instead of universal.

However, being that I already have a crowdfunded basic income, I’ve learned from experience that the most important element of UBI is in fact the “U.” Unconditionality is where most of its power lies, and unconditionality is inherently universal by reaching everyone via lack of imposed conditions. It’s for this reason, that I’d prefer to see every single citizen of the US, rich and poor alike, receive even $100 per month as a right of citizenship, than I would an arbitrarily defined group receive $1,000 per month while others receive nothing for being too old, or too young, or for earning “too much”, or for working in a way not considered “work.” A fully universal dividend can always be raised over time, and its popularity is already evidence-backed by the Alaska dividend that all Alaskans receive, where it’s so popular they’d rather begin paying state income taxes than lose their dividend, and where the dividend has increased part-time employment by 17%. Universality works.

Limiting receipt to certain approved groups I think risks unpopularity in the same way existing conditional benefits suffer damaging stigma. As a partial UBI, a carbon dividend would carry no stigma. A carbon dividend would grow over time. A carbon dividend would not be withdrawn as income is earned, unlike welfare which effectively punishes paid work, thus carbon dividends would reward all work. And a carbon dividend would immediately help to decelerate climate change and accelerate sustainable energies. It would be the entire country following Alaska’s lead, but instead of being based on shared ownership of oil, it would be based on shared ownership of the air.

“It is a position not to be controverted that the earth, in its natural uncultivated state was, and ever would have continued to be, the common property of the human race.” — Thomas Paine

Atmospheric Justice

As Thomas Paine himself wrote in Agrarian Justice over 200 years ago, “In advocating the case of the persons thus dispossessed, it is a right, and not a charity, that I am pleading for.” Our atmosphere belongs to all of us equally, and thus by right, those who pollute it, and thus dispossess us of what is rightfully ours, should compensate us. By taking our first step toward UBI in this kind of way, one that treats everyone as equals but where some pollute more than others and thus should pay more than others for the privilege, UBI is born as a right, not a charity, and as justice, not redistribution. As soon as we remove the U from UBI, even just temporarily, we risk it being hated by those not fortunate enough to receive it, but unfortunate enough to pay for it.

A carbon tax implemented in a revenue neutral way, where the revenue is distributed universally as citizen dividends, is in my opinion perhaps the single most transformative policy option available right now. It can be implemented immediately. It is an unconditional income that will reduce both poverty and inequality while also better enabling all forms of work, paid and unpaid, and in a way that can be extended to other revenue sources like land value and patent protection. For example, imagine an annual patent fee that doubles every year as the price paid for continued monopolistic exclusion from the public domain, where all the revenue goes to a dividend. And of course most importantly of all, carbon dividends very well could save us from climate catastrophe before it’s too late. They could save us from ourselves.

As long as people are forced with the fear of starvation to work for others to earn any income whatsoever, employment is our primary concern. It doesn’t matter what the nature of the employment is, it’s do that or starve. By establishing a citizen dividend of any size, even a small one, people will have more of a choice about how they work, how long, for whom, and for what. And if enough people are able to make more environmentally sustainable choices, surviving may just finally begin to give way to truly thriving.

Let’s change the world with carbon dividends for all, because the sky belongs to all of us.

“To preserve the benefits of what is called civilized life, and to remedy at the same time the evil which it has produced ought to be considered as one of the first objects of reformed legislation.” — Thomas Paine

Call to Action

If you live in the United States, there is already a bill for carbon dividends that you can call up your representatives in Congress to request they co-sponsor. It’s called the Energy Innovation and Carbon Dividend Act.

Special thanks to: Steven Grimm, Haroon Mokhtarzada, Larry Cohen, Andrew Stern, Floyd Marinescu, Roy Bahat, Stephane Boisvert, Topher Hunt, Sasha Barrese, Aaron Schultz, Daryl Smith, Dominic Wyler, Kian Alavi, Joanna Zarach, Ace Bailey, Justin Walsh, Gisele Huff, Daragh Ward, Albert Wenger, Chris Smothers, Natalie Foster, Michael Hrenka, Stephen Warley, Jack Canty, Will Ware, Chris Rauchle, BoNster, Richard Just, Rachel Perkins, Che Wagner, Jordan Lejuwaan, Carrie Mclachlan, Paul Godsmark, Daniel Brockman, Vladimir Baranov, Gray Scott, David Ihnen, Joe Ballou, Jack Wagner, Gerald Huff, Michael Honey, Danielle and Michael Texeira, Max Henrion, Catherine MacDonald, Arjun Banker, Dan O’Sullivan, Saura Naderi, Bryan Herdliska, Oliver Bestwalter, Kev Roberts, Chris Boraski, Christopher Anderson, Ron Lisle, Dylan Taylor, Brian Schwartz, Kai Wong, Nicolas Pouillard, Georg Baumann, Lisa Hallman, Jill Weiss, Stuart Mark, Andreas, Lawrence W Lee, Robert F. Greene, Erhan Altay, Robert Solovay, Elizabeth Balcar, Casey Young, Thomas Welsh, Kirk Israel, Lee Irving, Walter Schaerer, all my other funders for their support, and my amazing partner, Katie Smith.

Would you like to see your name here too?

Did you enjoy reading this? Please click the subscribe button and also consider making a monthly pledge in support of my daily advocacy of basic income for all.

_large.jpg)

UBI Guide Newsletter

Join the newsletter to receive the latest updates in your inbox.